0001737924falseN-2/A00017379242024-01-162024-01-160001737924dei:BusinessContactMember2024-01-162024-01-16xbrli:pureiso4217:USD0001737924ck0001737924:LimitedOperatingHistoryRiskMember2024-01-162024-01-160001737924ck0001737924:EconomicUncertaintyRiskMember2024-01-162024-01-160001737924ck0001737924:BusinessManagementRiskMember2024-01-162024-01-160001737924ck0001737924:CompetitiveMarketRiskMember2024-01-162024-01-160001737924ck0001737924:InflationRiskMember2024-01-162024-01-160001737924us-gaap:InterestRateRiskMember2024-01-162024-01-160001737924ck0001737924:ReferenceRateRiskMember2024-01-162024-01-160001737924ck0001737924:QuarterlyOperatingResultsRiskMember2024-01-162024-01-160001737924ck0001737924:GlobalClimateChangeRiskMember2024-01-162024-01-160001737924ck0001737924:EnvironmentalSocialAndGovernanceFactorsRiskMember2024-01-162024-01-160001737924ck0001737924:USCreditRatingRiskMember2024-01-162024-01-160001737924ck0001737924:GlobalPoliticalAndMarketConditionsRiskMember2024-01-162024-01-160001737924ck0001737924:LawsOrRegulationsRiskMember2024-01-162024-01-160001737924ck0001737924:TaxLegislationRiskMember2024-01-162024-01-160001737924ck0001737924:ChangesToUSTariffAndImportExportRegulationsRiskMember2024-01-162024-01-160001737924ck0001737924:ChangeInPoliciesAndStrategiesRiskMember2024-01-162024-01-160001737924ck0001737924:GlobalEmergenciesOrNaturalDisastersRiskMember2024-01-162024-01-160001737924ck0001737924:CybersecurityProtectionSystemsRiskMember2024-01-162024-01-160001737924ck0001737924:BankRelationshipsRiskMember2024-01-162024-01-160001737924ck0001737924:ElectronicDataSystemsRiskMember2024-01-162024-01-160001737924ck0001737924:LendingActivitiesLiabilityRiskMember2024-01-162024-01-160001737924ck0001737924:ManagerialAssistanceLiabilityRiskMember2024-01-162024-01-160001737924ck0001737924:SimilarReturnsRiskMember2024-01-162024-01-160001737924ck0001737924:SoftDollarsAndResearchReceivedRiskMember2024-01-162024-01-160001737924ck0001737924:SECReportingEntityRiskMember2024-01-162024-01-160001737924ck0001737924:EmergingGrowthCompanyRiskMember2024-01-162024-01-160001737924ck0001737924:SarbanesOxleyActRiskMember2024-01-162024-01-160001737924ck0001737924:EconomicRecessionsOrDownturnsRiskMember2024-01-162024-01-160001737924ck0001737924:MarketConditionsRiskMember2024-01-162024-01-160001737924ck0001737924:LeveragedPortfolioCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:MiddleMarketPrivatelyOwnedCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsInSeniorLoansRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentAndTradingOfLiquidAssetsRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsInJuniorOrSubordinatedDebtSecuritiesRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsInUnitrancheSecuredLoansAndSecuritiesRiskMember2024-01-162024-01-160001737924ck0001737924:CovenantLiteLoansRiskMember2024-01-162024-01-160001737924ck0001737924:SyndicatedLoansRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentInEquityRelatedSecuritiesRiskMember2024-01-162024-01-160001737924ck0001737924:LoansMayBecomeNonPerformingMember2024-01-162024-01-160001737924ck0001737924:InvestmentsLiquidityRiskMember2024-01-162024-01-160001737924ck0001737924:PriceDeclinesAndIlliquidityRiskMember2024-01-162024-01-160001737924ck0001737924:LoansPrepaymentRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsInSpecialSituationCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsInBusinessServicesIndustryRiskMember2024-01-162024-01-160001737924ck0001737924:HealthcareSectorRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsInLifeSciencesRelatedCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:TechnologyRelatedCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:OIDIncomeAndPIKInterestRiskMember2024-01-162024-01-160001737924ck0001737924:NonDiversifiedInvestmentCompanyRiskMember2024-01-162024-01-160001737924ck0001737924:DebtSecuritiesOfLeveragedCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentsPortfolioCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:ControlOfPortfolioCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:PortfolioCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:PortfolioCompaniesDebtRiskMember2024-01-162024-01-160001737924ck0001737924:PrivateCompaniesRiskMember2024-01-162024-01-160001737924ck0001737924:CoInvestmentsSyndicatingRiskMember2024-01-162024-01-160001737924ck0001737924:DependencyUponSeniorManagementRiskMember2024-01-162024-01-160001737924ck0001737924:ConflictsRelatedToObligationsOfSeniorInvestmentProfessionalsRiskMember2024-01-162024-01-160001737924ck0001737924:RecommendationsRiskMember2024-01-162024-01-160001737924ck0001737924:PossessionOfMaterialNonpublicInformationRiskMember2024-01-162024-01-160001737924ck0001737924:IncentivesRiskMember2024-01-162024-01-160001737924ck0001737924:IncentiveFeeRiskMember2024-01-162024-01-160001737924ck0001737924:CertainConflictsOfInterestRiskMember2024-01-162024-01-160001737924ck0001737924:TransactionsWithAffiliatesRiskMember2024-01-162024-01-160001737924ck0001737924:ResignRiskMember2024-01-162024-01-160001737924ck0001737924:AdministrationAgreementRiskMember2024-01-162024-01-160001737924ck0001737924:ConfidentialInformationRiskMember2024-01-162024-01-160001737924ck0001737924:DerivativesAndUnfundedCommitmentTransactionsRiskMember2024-01-162024-01-160001737924ck0001737924:FailureToQualifyAsABDCRiskMember2024-01-162024-01-160001737924ck0001737924:FairValueRiskMember2024-01-162024-01-160001737924ck0001737924:USFederalIncomeTaxRiskMember2024-01-162024-01-160001737924ck0001737924:IncomeRiskMember2024-01-162024-01-160001737924ck0001737924:BDCRegulationsRiskMember2024-01-162024-01-160001737924ck0001737924:LeverageRiskMember2024-01-162024-01-160001737924ck0001737924:CapitalMarketsDisruptionRiskMember2024-01-162024-01-160001737924ck0001737924:AssetCoverageRequirementRiskMember2024-01-162024-01-160001737924ck0001737924:CreditFacilitiesRiskMember2024-01-162024-01-160001737924ck0001737924:CreditFacilityDefaultRiskMember2024-01-162024-01-160001737924ck0001737924:A2022DebtSecuritizationRiskMember2024-01-162024-01-160001737924ck0001737924:SubordinatedObligationsOfCLOIRiskMember2024-01-162024-01-160001737924ck0001737924:ConflictsOfInterestAsCollateralManagerRiskMember2024-01-162024-01-160001737924ck0001737924:MaterialLimitationsWithMakingAvailablePreliminaryEstimatesRiskMember2024-01-162024-01-160001737924ck0001737924:PublicMarketRiskMember2024-01-162024-01-160001737924ck0001737924:DilutionRiskMember2024-01-162024-01-160001737924ck0001737924:ShareholdersMayExperienceDilutionRiskMember2024-01-162024-01-160001737924ck0001737924:SharesOfCommonStockHigherRiskMember2024-01-162024-01-160001737924ck0001737924:DilutionToNAVPerShareRiskMember2024-01-162024-01-160001737924ck0001737924:CommonStockSalesVolumeRiskMember2024-01-162024-01-160001737924ck0001737924:InvestorDistributionsRiskMember2024-01-162024-01-160001737924ck0001737924:DividendsDeferralRiskMember2024-01-162024-01-160001737924ck0001737924:StockDividendsRiskMember2024-01-162024-01-160001737924ck0001737924:InvestmentObjectiveRiskMember2024-01-162024-01-160001737924ck0001737924:MarketValueRiskMember2024-01-162024-01-160001737924ck0001737924:ChangeOfControlRiskMember2024-01-162024-01-160001737924ck0001737924:JurisdictionRiskMember2024-01-162024-01-160001737924ck0001737924:WellsFargoFinancingFacilityMember2024-01-162024-01-160001737924ck0001737924:SubscriptionFacilityMember2024-01-162024-01-160001737924ck0001737924:SMBCFinancingFacilityMember2024-01-162024-01-160001737924ck0001737924:CLOIMember2024-01-162024-01-160001737924ck0001737924:CreditFacilityRevolvingMember2024-01-162024-01-160001737924ck0001737924:SubscriptionFacilityMember2022-12-31iso4217:USDxbrli:shares0001737924ck0001737924:SubscriptionFacilityMember2021-12-310001737924ck0001737924:SubscriptionFacilityMember2020-12-310001737924ck0001737924:WellsFargoFinancingFacilityMember2023-06-300001737924ck0001737924:WellsFargoFinancingFacilityMember2022-12-310001737924ck0001737924:WellsFargoFinancingFacilityMember2021-12-310001737924ck0001737924:WellsFargoFinancingFacilityMember2020-12-310001737924ck0001737924:WellsFargoFinancingFacilityMember2019-12-310001737924ck0001737924:SMBCFinancingFacilityMember2023-06-300001737924ck0001737924:SMBCFinancingFacilityMember2022-12-310001737924ck0001737924:SMBCFinancingFacilityMember2021-12-310001737924ck0001737924:SMBCFinancingFacilityMember2020-12-310001737924ck0001737924:CLOIMember2023-06-300001737924ck0001737924:CLOIMember2022-12-310001737924ck0001737924:CreditFacilityRevolvingMember2023-06-300001737924ck0001737924:CreditFacilityRevolvingMember2022-12-310001737924us-gaap:CommonStockMember2024-01-162024-01-16xbrli:shares

As filed with the Securities and Exchange Commission on January 16, 2024

Securities Act File No. 333-276148

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-2

REGISTRATION STATEMENT

UNDER

| | | | | | | | |

THE SECURITIES ACT OF 1933 |

| ☒ |

Pre-Effective Amendment No. 2 |

| ☒ |

Post-Effective Amendment No. |

| ☐ |

Nuveen Churchill Direct Lending Corp.

(Exact Name of Registrant as Specified in Charter)

375 Park Avenue, 9th Floor

New York, New York 10152

(Address of Principal Executive Offices)

(212) 478-9200

(Registrant’s Telephone Number, including Area Code)

John McCally

General Counsel

Churchill Asset Management LLC

8500 Andrew Carnegie Blvd

Charlotte, NC 28262

(Name and Address of Agent for Service)

WITH COPIES TO:

| | | | | |

Steven B. Boehm, Esq. Payam Siadatpour, Esq. Owen J. Pinkerton, Esq. Sara Sabour Nasseri, Esq. Eversheds Sutherland (US) LLP 700 Sixth Street, NW Washington, DC 20004 Tel: (202) 383-0100 | Paul D. Tropp, Esq. Ropes & Gray LLP 1211 Avenue of the Americas New York, NY 10036 Tel: (212) 596-9000 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

| | | | | |

| ☐ | Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. |

| ☐ | Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. |

| ☐ | Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| ☐ | Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

| ☐ | Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will become effective (check appropriate box)

| | | | | |

| ☐ | when declared effective pursuant to Section 8(c) of the Securities Act. |

If appropriate, check the following box:

| | | | | |

☐ | This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

| ☐ | This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: _______. |

| ☐ | This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is:_______. |

| ☐ | This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is:_______. |

Check each box that appropriately characterizes the Registrant:

| | | | | |

☐ | Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). |

| ☒ | Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act). |

| ☐ | Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). |

| ☐ | A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

| ☐ | Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| ☒ | Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). |

| ☐ | If an Emerging Growth Company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| ☐ | New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 16, 2024

PRELIMINARY PROSPECTUS

Nuveen Churchill Direct Lending Corp.

5,500,000 Shares of Common Stock

We are a specialty finance company organized to maximize the total return to our shareholders in the form of current income achieved through primarily investing in senior secured loans to private equity-owned U.S. middle market companies.

Our investment objective is to generate attractive risk-adjusted returns through current income by primarily investing in senior secured loans to private equity-owned U.S. middle market companies, which we define as companies with $10 million to $250 million of annual earnings before interest expense, income tax expense, depreciation and amortization (“EBITDA”). We primarily focus on investments in U.S. middle market companies with $10 million to $100 million of annual EBITDA. Our portfolio is comprised primarily of first-lien senior secured debt and unitranche loans. Although it is not our primary strategy, we also opportunistically invest in junior capital opportunities, including second-lien loans, subordinated debt and equity co-investments and similar equity-related securities. Subject to the pace and amount of investment activity in our middle market investment program, our portfolio also may be comprised of cash and cash equivalents, liquid fixed-income securities (including broadly syndicated loans) and other liquid credit instruments. The debt in which we invest typically is not rated by any rating agency, but if these instruments were rated, they would likely receive a rating of below investment grade (that is, below BBB- or Baa3), which is often referred to as “high yield” or “junk”.

We are an externally managed, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended. We are managed by our investment adviser, Churchill DLC Advisor LLC, and our investment sub-adviser, Churchill Asset Management LLC. We have elected, and intend to qualify annually, to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. As a BDC and a RIC, we are required to comply with certain regulatory requirements.

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, and will be subject to reduced public company reporting requirements.

This is our initial public offering of our shares of common stock and all of the shares of common stock offered by this prospectus are being sold by us.

Our board of directors has approved a share repurchase program (the “Company 10b5-1 Plan”), pursuant to which the Company may purchase up to $100 million in the aggregate of our outstanding shares of common stock in the open market at certain thresholds over a specified period. See “Prospectus Summary — Share Repurchase Plan.” The purchase of shares under the Company 10b5-1 Plan will be conducted in accordance with the guidelines and conditions of Rule 10b5-1 and Rule 10b-18 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Our shares of common stock have no history of public trading. We currently expect that the initial public offering price per share of our common stock will be $18.05 per share. We have applied to have our common stock listed on the New York Stock Exchange (“NYSE”) under the symbol “NCDL.”

Assuming an initial public offering price of $18.05 per share, purchasers in this offering will not experience any immediate dilution based on our September 30, 2023 NAV per share, as adjusted, of $18.05. See “Dilution” for more information.

Investing in our common stock involves a high degree of risk, including credit risk and the risk of the use of leverage, and is highly speculative. In addition, shares of closed-end investment companies, including BDCs, frequently trade at a discount to their net asset values (“NAV”). If shares of our common stock trade at a discount to our NAV, purchasers in this offering will face increased risk of loss. Before buying any shares of our common stock, you should read the discussion of the material risks of investing in our common stock, including the risk of leverage, in “Risk Factors” beginning on page 31 of this prospectus. This prospectus contains important information you should know before investing in our common stock. Please read this prospectus before investing and keep it for future reference. We also file annual, quarterly, and current reports, proxy statements and other information about us with the U.S. Securities and Exchange Commission (the “SEC”). This information is available free of charge by contacting us at 375 Park Avenue, 9th floor, New York, NY 10152, calling us at (212) 478-9200 or visiting our corporate website located at www.ncdl.com. Information on our website is not incorporated into or a part of this prospectus, and you should not consider that information to be part of this prospectus. The SEC also maintains a website at www.sec.gov that contains this information.

Neither the SEC nor any state securities commission, nor any other regulatory body, has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| Per

Share | | Total |

Public offering price | $ | | $ |

Sales load (underwriting discounts and commissions) paid by us (1) | $ | — | | | $ | — | |

Proceeds to us, before expenses (2) | $ | | $ |

__________________

(1)Churchill or its affiliate will pay the entire sales load (underwriting discounts and commissions) payable to the underwriters in connection with this offering. We are not obligated to repay any such sales load (underwriting discounts and commissions) paid by Churchill or its affiliate. See “Underwriting” for a more complete description of underwriting compensation. Churchill or its affiliate will not pay any sales load on the shares of common stock, if any, sold to certain officers, employees, business associates and related persons of Churchill. Such officers, employees, business associates and related persons of Churchill will purchase such shares of common stock, if any, at the public offering price.

(2)Offering expenses are estimated to be approximately $2.50 million. Churchill or its affiliate will pay all of such offering costs associated with this offering on our behalf. We are not obligated to repay any such offering costs paid by Churchill or its affiliate.

We have granted the underwriters an option to purchase up to an additional 825,000 shares of our common stock from us, at the public offering price, less the sales load payable by us, within 30 days from the date of this prospectus.

The underwriters expect to deliver the shares of our common stock on or about , 2024.

| | | | | | | | | | | | | | |

| Joint Book-Running Managers |

| | | | |

| BofA Securities | UBS Investment Bank | Morgan Stanley | Wells Fargo Securities | Keefe, Bruyette & Woods |

| | | | A Stifel Company |

| | | | |

| JMP Securities | | | | Truist Securities |

| A CITIZENS COMPANY | | | | |

| | | | |

Co-Managers |

| | | | |

MUFG | SMBC Nikko | | Academy Securities | Blaylock Van, LLC |

The date of this prospectus is , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

Please carefully read the information in this prospectus. You should rely only on the information contained in this prospectus. Neither we nor the underwriters have authorized any other person to provide you with different information or to make representations as to matters not stated in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others give you. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus may only be used where it is legal to sell these securities. You should not assume that the information included in this prospectus is complete and accurate as of any date other than its date, regardless of the time of delivery of this prospectus or of any of our common stock.

In this prospectus, except where the context suggests otherwise:

•the terms “we,” “us,” “our,” and the “Company” refer to Nuveen Churchill Direct Lending Corp. (f/k/a Nuveen Churchill BDC Inc.) together with its consolidated subsidiaries;

•the term “Adviser” refers to Churchill DLC Advisor LLC, our investment adviser, pursuant to the Investment Advisory Agreement, dated December 31, 2019 (the “Advisory Agreement”);

•the term “Churchill” or “Sub-Adviser” refers to Churchill Asset Management LLC, which serves as our investment sub-adviser as delegated by the Adviser pursuant to the Sub-Advisory Agreement between the Adviser and Churchill (initially dated December 31, 2019 and amended and restated on December 11, 2020, October 7, 2021 and March 8, 2022, the “CAM Sub-Advisory Agreement” and, together with the Advisory Agreement, the “Advisory Agreements”);

•the term “Nuveen Asset Management” refers to Nuveen Asset Management, LLC, which, acting through its leveraged finance division, may manage certain of our liquid investments pursuant to a sub-investment advisory agreement by and among the Adviser, Churchill and Nuveen Asset Management (the “NAM Sub-Advisory Agreement”);

•the term “Advisers” collectively refers to the Adviser, Churchill and Nuveen Asset Management;

•the term “Administrator” refers to Churchill BDC Administration LLC, which serves as our administrator; and

•the term “committed capital” refers to the capital committed to client accounts in the form of equity capital commitments from investors, as well as committed, actual or expected financing from leverage providers (including asset-based leveraged facilities, notes sold in the capital markets or any capital otherwise committed and available to fund investments that comprise assets under management). For purposes of this calculation, both drawn and undrawn equity and financing commitments are included. In determining committed capital in respect of funds and accounts that utilize internal asset-based leverage (e.g., levered funds and CLO warehouses), committed capital calculations utilize a leverage factor that assumes full utilization of such asset-based leverage in accordance with the account’s target leverage ratio as disclosed to investors. In determining committed capital in respect of Churchill’s management of an institutional separate account for its parent company, TIAA (as defined below), (i) committed capital in respect of private equity fund interests includes commitments made by TIAA to such strategy over the most recent 10 years, and the NAV of all such investments aged more than 10 years, and (ii) committed capital in respect of equity co-investments, junior capital investments, structured capital investments, and senior loans includes the commitment made by TIAA for the most recent year, and the outstanding principal balance of investments made in all preceding years. In determining committed capital in respect of Churchill’s management of institutional separate accounts for third party institutional clients, committed capital includes the aggregate commitments made by such third party clients, so long as such commitments remain subject to recycling. Thereafter, outstanding principal balance is used in respect of any applicable commitment (or portion thereof) that has expired. Due to the foregoing, committed capital figures may be adjusted over the course of a financial period, based on accounts transitioning the calculation methodology from capital commitment to invested capital.

Each of the Adviser, Churchill and Nuveen Asset Management are investment advisers registered with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and are controlled by Nuveen, LLC (“Nuveen”). Nuveen is the investment management arm of Teachers Insurance and Annuity Association of America (“TIAA”), a life insurance company founded in 1918 by the Carnegie Foundation for the Advancement of Teaching and the companion organization of College Retirement Equities Fund. Unless otherwise noted, statistical information and data relating to Churchill, Nuveen, and TIAA, the ultimate parent of Churchill and Nuveen, is approximate as of December 31, 2022.

Statistical and market data used in this prospectus has been obtained from independent industry sources and publications. We have not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements contained in this prospectus. See “Special Note Regarding Forward-Looking Statements”.

We have not, and the underwriters have not, authorized anyone to give you any information other than information contained in this prospectus, and we take no responsibility for any other information that others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. We will update these documents to reflect material changes only as required by law.

PROSPECTUS SUMMARY

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider before investing in shares of our common stock. You should read our entire prospectus before investing in our common stock.

Nuveen Churchill Direct Lending Corp.

We are a specialty finance company focused primarily on investing in senior secured loans to private equity-owned U.S. middle market companies. We are externally managed by our Adviser, Churchill DLC Advisor LLC, and through our Sub-Adviser, Churchill Asset Management LLC. Both our Adviser and our Sub-Adviser are affiliates and subsidiaries of Nuveen, the investment management division of TIAA and one of the largest asset managers globally. We invest in directly originated senior secured loans that typically pay floating interest rates and are senior in the capital structure to junior debt and equity, as we believe these loans offer us more attractive risk-adjusted returns and stronger protections than investments in the traditional public debt capital markets. We seek to partner with high quality, private equity-owned middle market companies that have strong management teams executing on long-term growth strategies. Additionally, the private equity sponsors that own the businesses we lend to typically have the ability and strong incentive to support their portfolio companies by providing additional capital and managerial and operational assistance. We believe this support could potentially enhance the performance of our portfolio companies and provide additional protections for our investments.

We were formed as a Delaware limited liability company in March 2018 and we converted into a Maryland corporation in June 2019. We are a closed-end, externally managed, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). In addition, we have elected, and intend to qualify annually, to be treated for U.S. federal income tax purposes as a regulated investment company (a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

Our investment objective is to generate attractive risk-adjusted returns through current income by investing primarily in senior secured loans to private equity-owned U.S. middle market companies, which we define as companies with $10 million to $250 million of EBITDA.1 We primarily focus on investments in U.S. middle market companies with $10 million to $100 million of EBITDA, which we consider the core middle market. Our portfolio is comprised primarily of first-lien senior secured debt and unitranche loans. Although it is not our primary strategy, we also opportunistically invest in junior capital opportunities, including second-lien loans, subordinated debt, equity co-investments and similar equity-related securities. Subject to the pace and amount of investment activity in our middle market investment program, our portfolio also may be comprised of cash and cash equivalents, liquid fixed-income securities (including broadly syndicated loans) and other liquid credit instruments.

The Adviser has delegated substantially all of its daily portfolio management obligations to Churchill Asset Management LLC, our Sub-Adviser. With over 150 professionals and approximately $50 billion of committed capital as of January 1, 2024, Churchill is a leading capital provider for private equity-backed middle market companies and operates as the exclusive U.S. middle market direct lending and private capital business of Nuveen and TIAA. Of approximately $50 billion of committed capital, approximately $13 billion is comprised of committed capital that supports a carefully constructed portfolio of primary limited partner capital commitments made by TIAA and certain other institutional investor clients of Churchill to approximately 300 private equity funds primarily focused on the U.S. middle market. This long-standing and growing portfolio of limited partner capital commitments positions Churchill as one of the largest and most active private equity fund investment managers focused on the core U.S. middle market. We believe Churchill’s ability to originate investment opportunities benefits from its fully integrated investment program, which includes passive, non-controlling, minority limited partner and direct equity interests in private equity funds and their portfolio companies. Rather than limiting its investment activities solely to loan and financing transactions, Churchill engages with third-party, unaffiliated private equity firms through such equity investment program. We believe that this positions Churchill as a valuable source of capital to these private equity firms, and that this increases Churchill’s ability to source differentiated investment opportunities across its investment platform, often on an early look, first access basis. Churchill offers a full array of solutions across the

1 The term “EBITDA” refers to earnings before interest, taxes, depreciation and amortization.

capital structure, benefiting from the investment guidance of its principals who have a long history of disciplined investing in the middle market across various economic cycles. With over $30 billion of committed capital dedicated to middle market private credit across more than 30 affiliated investment vehicles as of January 1, 2024, Churchill supports our ability to invest in larger transactions while limiting issuer and industry concentration in our investment portfolio. While it is managed and operated independently of TIAA and Nuveen, Churchill benefits from the scale, capital and resources of its parent companies, which we believe gives it the unique perspective of an asset owner while it executes its investment management strategies in the middle market through its network of leading private equity relationships.

Investment Portfolio

We target an investment portfolio comprised of at least 80% and up to 100% in first-lien senior secured debt and unitranche loans. To a lesser extent, we have and may continue to opportunistically invest in second-lien loans, subordinated debt, equity co-investments and similar equity-related securities. We are highly focused on constructing a diverse investment portfolio with broad diversification by company, industry sectors, and position size, targeting an average investment size of 1 to 2% per company. While we will seek to achieve the targets described above, the composition of our investment portfolio may vary from time to time due to various factors, such as market conditions and the availability of attractive investment opportunities.

In addition, we do not hold any funded or unfunded revolving loan commitments in respect of our portfolio companies, and all of our investments in senior loans are comprised of funded term loans or delayed-draw term loan commitments. Therefore, we believe our portfolio is less likely to experience sudden changes to diversification or liquidity needs stemming from the utilization of revolving loan commitments.

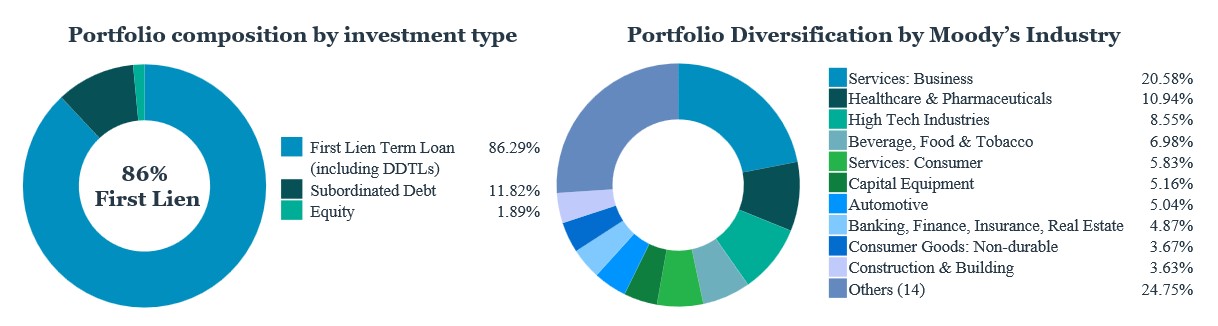

Below is information relating to our investment portfolio as of September 30, 2023:

•We had debt investments and equity investments in 174 portfolio companies with an aggregate of approximately $1.48 billion at fair value and an average position size of $8.5 million, or 0.57% at fair value.

•Our portfolio consisted of 86.29% first-lien term loans, 11.82% subordinated debt investments, and 1.89% equity investments, based on fair value.

•Approximately 85% of our debt investments have financial covenants.2

•The weighted average yield on our debt and income producing investments at fair value was 11.85%.3

•Our portfolio companies had a weighted average annual EBITDA of $74.2 million.4

•Approximately 94% of the debt investments in our portfolio were subject to floating interest rates, based on fair value.

2 Represents the percentage of debt investments with one or more maintenance financial covenants, based on the fair market value as of September 30, 2023.

3 The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount, but excluding investments on non-accrual status, if any. There can be no assurance that historical weighted average yield of our portfolio companies will remain at its current level.

4 This calculation includes all private debt investments for which fair value is determined by the Adviser in its capacity as the Board’s valuation designee, and excludes quoted assets. Amounts are weighted based on the fair value of each respective investment as of its most recent quarterly valuation, which are derived from the most recently available portfolio company financial statements.

•The interest coverage ratio for our first lien loans was 2.40x.5

•The net leverage of our debt investments was 4.9x.6

•Our portfolio is invested across 24 different industries, as such industries are classified by Moody’s Investors Service, Inc. The largest industries in our portfolio are Business Services, Healthcare & Pharmaceuticals, and High Tech Industries, which represented, as a percentage of our portfolio at fair value, 20.58%, 10.94%, and 8.55%, respectively.

Overview of Market Opportunity

We believe that the private U.S. middle market is an attractive target market in terms of its size, investment opportunities and the trends supporting private equity ownership and direct lending investment within the space based on the following factors:

Large, Resilient and Attractive Addressable Market

The U.S. middle market is comprised of nearly 200,000 companies and serves as the primary source of deal flow for private credit providers.7 These middle market businesses collectively generate annual revenues in excess of $6 trillion, which represents approximately one-third of private sector gross domestic product (GDP)4 in the United States. If it were a standalone economy, the U.S. middle market would be the third largest economy in the world based on GDP.4 Within the middle market sector, we focus on the segment that includes companies with $10 million to $100 million of EBITDA because we believe these middle market companies generally are well-positioned to withstand economic downturns due to resilient revenue streams, access to supportive capital, and multiple value creation opportunities to enhance business models and professionalize operations to drive higher growth rates. We believe this market segment has historically been underserved by traditional and other financial institutions, creating an attractive and compelling investment opportunity for direct lenders like us. Less than 5% of the approximately 200,000 U

5 The interest coverage ratio calculation is derived from the most recently available portfolio company financial information received by the Adviser, and is a weighted average based on the fair market value of each respective first lien loan investment as of its most recent reporting to lenders. Such reporting may include assumptions regarding the impact of interest rate hedges established by borrowers to reduce their exposure to floating interest rates (resulting in a reduced hedging rate being used for the total interest expense in respect of such hedges, rather than any higher rates applicable under the documentation for such loans), even if such hedging instruments are not pledged as collateral to lenders in respect of such loans and do not secure the loans themselves. The interest rate coverage ratio excludes junior capital investments and equity co-investments, and applies solely to traditional middle market first lien loans held by us, which also excludes any upper middle market or other first lien loans investments that do not have maintenance financial covenants, and first lien loans that the Adviser has assigned a risk rating of ‘8’ or higher, as well as any portfolio companies with net senior leverage of 15x or greater. As a result of the foregoing exclusions, the interest coverage ratio shown herein applies to 71.46% of our total investments, and 82.82% of our total first lien loan investments, in each case based upon fair value as of September 30, 2023.

6 Net leverage is the ratio of total debt minus cash divided by EBITDA, taking into account only the debt issued through the tranche in which we are a lender. Leverage is derived from the most recent portfolio company financial statements available as of September 30, 2023, and weighted by the fair value of our commitment as of September 30, 2023. Net leverage presented excludes equity investments as well as debt instruments to which the Adviser has assigned a risk rating of 8 or higher, and any portfolio companies with net leverage of 15x or greater.

7 Source: World Economic Outlook Database; Middle Market assumption based on the definition by National Center for the Middle Market.

.S. middle market companies have private equity backing, implying opportunity for further investment by private equity funds and debt financing by private credit providers that we believe may benefit us.8

Robust, Growing Demand for Private Credit

We believe the demand for private credit in the U.S. middle market meaningfully outpaces supply. As of December 31, 2022, U.S. private equity firms had $775 billion in uninvested private equity capital available for investment, or dry powder.9 Private equity firms are expected to be highly motivated to deploy this uninvested capital before the end of their investment periods, typically three to five years. Assuming a capitalization of 50% equity in a typical leveraged buyout transaction, this equates to nearly $775 billion in new financing demand over the next several years as this private equity capital is deployed. This demand meaningfully outpaces the nearly $150 billion of uninvested U.S. middle market private debt capital as of December 31, 2022, representing a $625 billion dry powder gap for private debt capital.10 In other words, the current amount of private equity dry powder is over five times the current amount of private debt dry powder. We believe U.S. middle market companies will continue to need debt financing for potential acquisitions by private equity firms, supporting organic growth and refinancing of existing debt obligations.

In addition, we anticipate that there is a significant need for refinancing of existing loans made to middle market companies. Over $600 billion middle market loans are expected to mature between 2023 and 2029,11 which should provide a steady flow of attractive opportunities for well-positioned lenders with deep and long-standing sponsor and market relationships. Combined with what we believe is the middle market loan demand based on current private equity dry powder, this equates to a total estimated financing need of over $1.4 trillion over the next five years. We expect that these factors should result in a very favorable environment for lenders with a steady source of capital, differentiated sourcing capabilities and an experienced investment team that can appropriately assess the opportunity set.

Multiple Benefits to Investing in Middle Market Senior Secured Loans

We believe middle market senior secured loans are attractive investments when compared to similar fixed-income investments in the public credit markets, because such investments typically are issued pursuant to direct negotiation between a portfolio company and a small group of institutional investors and are not widely traded in the public credit markets. As a result, we believe that middle market senior secured loans can potentially enhance overall portfolio yield through attractive risk-adjusted returns that are driven by favorable structuring advantages that can, in turn, create the potential for lower loss rates and higher interest rate margins when compared to public credit market alternatives. At the same time, we believe that these returns may be less likely to be negatively impacted by the volatility in the public trading markets. Given the more limited sources of financing and increased complexity required to underwrite private middle market loans, middle market companies typically pay higher interest rates relative to large corporate borrowers of similar credit quality. From a structure perspective, middle market companies are typically less levered, have larger sponsor equity contributions, and are often subject to maintenance and financial covenants, which affords lenders better protections in the event of credit deterioration. Additionally, middle market lenders have greater access to company information and often perform due diligence alongside the acquiring private equity sponsor, receiving detailed company reports, third-party industry reports, and quality of earnings analyses.

We believe that opportunities associated with senior secured loan investments in middle market companies are also attractive because of the defensive nature of these types of investments, which are senior on a lien basis to other liabilities within the capital structure (i.e., senior secured debt has payment priority ahead of junior debt and equity holders). Moreover, senior secured loans are particularly attractive in the current rising rate environment given they are typically issued with floating interest rate structures, which are generally less susceptible to declines in value in a rising interest rate environment compared to fixed-rate securities.

8 Source: Rothschild & Co, Why the US Middle Market is Attractive for Private Equity Investors (Sept. 20, 2022).

9 Source: Uninvested Private Equity Capital from Pitchbook PE VC Fundraising Mid-Year, data as of Q4 2022.

10 Source: Preqin, Note: North American Data Only.

11 Source: Total Middle Market Maturities (Sponsored and Non-Sponsored) from Refinitiv LPC, as of Q4 2022.

Decline in Traditional Bank Lending Drives More Opportunities for Non-Bank Lenders

The middle market was historically a sector of the U.S. economy served by commercial banks and other traditional lenders. However, since the Global Financial Crisis of 2008-2009, we believe that increased capital requirements and regulatory burdens have reduced the capacity of traditional regulated financial institutions and constrained their ability to serve private middle market companies. As a result, many commercial banks and other traditional lenders have shifted their focus more towards broadly syndicated and liquid deals, while also providing fee-based services that require less capital, creating significant opportunities for non-bank, private credit providers. In addition, the recent volatility in the traditional banking sector, particularly within the smaller regional and niche lending institutions, has, in turn, created more volatility in the broadly syndicated and public markets, driving larger borrowers to turn to the private lending markets that remain open and supportive. For the nine months ended September 30, 2023, the share of middle market leveraged buyout volume by direct lending providers compared to the syndicated market reached 84%, up from 80% in the full year of 2022, 75% in the full year of 2021 and 66% in the full year of 2020.12 We believe private direct lending platforms will continue to expand their share of the lending market, while benefiting from the influx of larger more established borrowers that would have otherwise accessed the syndicated and public credit markets.

Evolving Dynamics of Sponsor Financing

Private equity sponsors and their portfolio companies are increasingly interested in working directly with private credit managers as they realize the benefits over accessing capital through more traditional public debt markets. These benefits include greater customization, longer maturity profiles, speed and flexibility in transaction execution and confidentiality. Through our experience and understanding of the market, private equity sponsors are increasingly seeking to partner with lenders of scale that have balance sheet strength, strong transaction execution and longstanding reputations, and who can lead or be meaningful participants in the loans to their portfolio companies. In addition, private equity sponsors are leaning toward lenders with significant capacity and ample dry powder to support incremental financing needs to pursue M&A activity and drive growth. This has resulted in a consolidation of preferred lender groups where first calls and early access are critical to accessing high quality deal flow. We believe we are well-positioned given Churchill’s strong sourcing capabilities, conservative focus and ability to act as an arranger with a larger hold position in middle market deals.

Competitive Advantages

We believe that our competitive advantages stem from long-standing market presence, significant lending capacity, scale to support attractive investments, strong relationships with private equity firms, differentiated sourcing capabilities and ability to compete on factors other than pricing. Further, we believe that Churchill has built a reputation of professionalism and collaboration that positions us to be a preferred capital provider to support the needs of private equity sponsors. We believe Churchill has the scale, platform, and unique capabilities to effectively manage our U.S. private credit investment strategy, offering investors the following competitive advantages:

Scaled Platform with Extensive Private Credit Expertise

Since 2006, Churchill’s senior leadership team has worked together to establish a cycle-tested track record in direct lending and private capital investments, and today, we believe that Churchill is one of the largest managers of private capital investments. The Churchill team has deep middle market investment expertise, providing customized financing solutions to private equity-backed middle market companies across the capital structure, including senior loans, junior capital, equity co-investments and similar equity-related securities. Overseeing approximately $50 billion in committed capital as of January 1, 2024 and deploying nearly $10 billion in the last twelve-month period ended September 30, 2023 across its multiple investment strategies, Churchill is one of the most active direct lenders in the U.S. middle market. With over 150 dedicated professionals in New York, Charlotte, Chicago, Los Angeles and Dallas, Churchill operates a fully integrated investment platform with advanced infrastructure, risk management, investor relations, finance, operations, and legal support functions. The scale of Churchill’s platform provides us with the ability to invest in larger transactions with limited concentration in our portfolio. We believe that the breadth and depth of Churchill’s expertise, coupled with its long history of disciplined investment across industries

12 Source: Refinitiv LPC’s 3Q23 Private Deals Analysis.

and various economic cycles, provides differentiated strengths when sourcing and evaluating large and complex investment opportunities.

Unique Benefits from Alignment with Nuveen and TIAA

Churchill benefits substantially from the scale and resources of its parent company, Nuveen, and Nuveen’s ultimate parent company, TIAA. Nuveen, as the investment management division of TIAA, is one of the world’s largest asset managers with $1.1 trillion assets under management as of September 30, 2023, of which approximately $111 billion is invested in private capital. TIAA, a leading provider of secure retirement and outcome-focused investment solutions to millions of people and over 12,000 institutions as of June 30, 2023, is the second largest private debt investor in the world.13 Together, TIAA and Nuveen have been investors in the private debt and equity markets for over 40 years.

Leveraging the scale, capital and resources of Nuveen’s platform, Churchill is able to focus on its middle market investment expertise. Specifically, Nuveen’s distribution capabilities from its approximately 180 person U.S. wealth coverage team enable Churchill to prioritize originating, underwriting and managing its high quality, diversified portfolios while relying on Nuveen’s retail and wealth distribution platform.

TIAA is an important part of Churchill’s committed capital base, as Churchill manages TIAA’s general account allocation to U.S. middle market private capital side-by-side with Churchill’s third-party investors. This provides for a unique alignment of interests that we believe causes Churchill to think and act like a long-term investor in the asset class.

As of September 30, 2023, we had received capital commitments totaling approximately $906.4 million, of which $100.0 million (approximately $26.7 million remaining undrawn) is from TIAA. As such, TIAA beneficially owned approximately 10.32% of our outstanding shares of common stock as of September 30, 2023.

Strong Private Equity Relationships and Fund Investments Drive Proprietary Origination Opportunities

Churchill believes it has established itself as a highly value-additive capital provider and partner of choice for leading private equity firms given its ability to provide a full array of scaled solutions across the capital structure. Churchill’s dedicated loan origination team has cultivated deep, long-standing relationships with over 400 middle market private equity firms across diversified strategies, industry focus and U.S. geographies. Of approximately $50 billion of committed capital as of January 1, 2024, approximately $13 billion is comprised of committed capital that supports a carefully constructed portfolio of primary limited partner capital commitments made by TIAA and certain other institutional investor clients of Churchill to approximately 300 private equity funds primarily focused on the U.S. middle market. This long-standing and growing portfolio of limited partner capital commitments positions Churchill as one of the largest and most active private equity fund investment managers focused on the core U.S. middle market. We believe Churchill’s role as a valuable limited partner and its fully integrated partnership approach helps drive differentiated origination opportunities often on an early look, first access basis. Additionally, we believe Churchill’s deep network of private equity relationships and representation on hundreds of private equity fund advisory boards further enhances Churchill’s proprietary deal sourcing advantages while remaining highly selective of investment opportunities without compromising on its stringent underwriting standards or transaction terms. Churchill is a trusted and desired financing partner, demonstrated by its ability to earn the lead or co-lead role in over 80% of its senior loan transaction volume in the trailing twelve-month ended September 30, 2023. In this capacity, Churchill is able to structure and negotiate transactions directly with the private equity sponsor, driving efficiencies and stronger relationships, often leading to the sponsor’s decision to select Churchill as a lead lending partner for subsequent transactions as well. Churchill’s sourcing strategy is not, however, entirely centered on leading every transaction as it also partners with other middle market lenders on attractive investment opportunities, helping to drive a more stable and reliable capital deployment pace in the middle market.

13 Source: Rankings published in the Private Debt Investor Magazine’s Global Investor 50, Nov. 1, 2022. Private Debt Investor Magazine’s research and analytics team carried out primary and secondary research on more than 100 institutions to produce rankings on the world’s largest institutional private debt investors based on the market value of private debt portfolios. Nuveen submitted data to the research and analytics team. There were no fees paid in connection with this recognition.

Many of Churchill’s senior management and investment team members have held senior positions at other middle market lending firms and continue to maintain strong relationships with numerous active participants in the segment. These long-established relationships help source incremental investment opportunities and contribute to the high levels of deal flow with approximately 1,000 first-lien senior secured debt and unitranche loan investment opportunities reviewed per year. In contrast, peer lenders who focus primarily on lead agency roles often can find themselves in direct competition with one another adversely impacting deal flow and selectivity. Churchill’s dual sourcing model emphasizes long-term partnerships, ensuring that Churchill can focus exclusively on investment credit quality. We believe we are well-positioned to take advantage of the demand for capital in the middle market, particularly from private equity sponsored middle market companies.

Ability to Deliver Scaled and Flexible Capital Solutions

We believe Churchill’s ability to provide a variety of capital solutions and to invest opportunistically across the capital structure is a key differentiator and highly valued by private equity sponsors. Churchill is able to provide a comprehensive set of customized capital solutions to meet the needs of the borrower. With respect to senior loans, the investment team can opportunistically pivot between traditional first-lien senior secured loans and unitranche loans, as well as offer delayed draw term loans, in order to deliver the most attractive risk-adjusted returns. Further, the investment team’s partnership approach offers a strong value proposition to private equity firms, as one of a handful of middle market lenders with the ability to commit up to $500 million per transaction. This flexibility and the ability to deliver a fully underwritten solution ensures that Churchill has exposure to a wide range of transactions enabling it to be highly selective with respect to investment opportunities. Additionally, with respect to junior capital opportunities, the investment team has the ability to pivot between junior secured or unsecured debt instruments. Having the latitude to pivot across capital solutions differentiates Churchill compared to most other direct lenders in situations when capital requirements change during a transaction and thereby has positioned it as the preferred capital partner for private equity sponsors.

Disciplined and Rigorous Investment Approach with Comprehensive Portfolio Monitoring

Selectivity, broad industry diversification and rigorous underwriting standards are key to Churchill’s investment philosophy. Churchill provides us with a large and diverse pipeline of middle market investment opportunities, enhancing our ability to be highly selective and to maintain stringent underwriting standards and a diversified portfolio across sectors. Churchill employs a multi-step selection process when reviewing each potential investment opportunity that includes analyzing business prospects, thoroughly reviewing historical and pro forma financial information, meeting and discussing the business with the management team and private equity sponsor, understanding sponsor investment strategy and risk considerations, evaluating industry diligence to determine market position and competitive advantages, and assessing the track record of the private equity sponsor and its historical investments in other businesses.

Using a disciplined and cycle-tested investment approach, Churchill’s investment teams seek to limit credit losses through comprehensive due diligence of portfolio company fundamentals, terms and conditions and covenant packages. Following the closing of each investment, the investment professionals who initially underwrite the opportunity typically lead the hands-on portfolio monitoring effort to ensure continuity and the ability to respond efficiently to any portfolio company requests. Churchill implements a regimented credit monitoring system that involves a variety of discussions, analyses and reviews by its investment professionals on a daily, weekly, monthly, and quarterly basis, depending on the assessed monitoring need, which we believe enables Churchill to proactively detect and identify potential challenges at portfolio companies. See “The Company – Investment Process Overview.”

Proven Leadership Team with Extensive Private Capital Experience Across Economic Cycles

Churchill is led by industry veterans who bring on average more than 25 years of experience in middle market investing, the majority of whom have worked together for over a decade and have demonstrated an ability to prudently invest across various economic cycles at Churchill and its predecessor entities. Churchill was founded by current senior management team members Kenneth Kencel, Randy Schwimmer and Christopher Cox (the “Churchill Founders”), who have together unanimously approved all of the over 800 senior loans made by Churchill and its

predecessor entities since 2006. This core management team has been strengthened with the addition of several additional senior executives from Churchill’s predecessor entities and its ultimate parent company, TIAA. Among these additional senior management colleagues are Mathew Linett and Shai Vichness, who comprise the remaining members of the investment committee dedicated to senior loan opportunities alongside the Churchill Founders. Additionally, in connection with its affiliation with TIAA, Churchill assumed management of TIAA’s private equity and junior capital investment management platform, resulting in a unified middle market private capital asset management firm that capitalizes on opportunities throughout the U.S. sponsor-backed middle market.

Investment Selection Criteria

We primarily invest in first-lien senior secured debt and unitranche loans. In addition, we have and may continue to invest opportunistically in (i) secured second-lien loans, (ii) subordinated loans (both secured and unsecured) that provide for high fixed interest rates with substantial current interest income, and potentially equity participation or warrants that materially enhance the overall return of the security, and (iii) equity co-investments alongside private equity sponsors in a limited number of transactions where we believe the potential returns are attractive.

We have identified a number of key attributes when evaluating new investment opportunities that are aimed at offering attractive risk / reward characteristics. Our objective is to invest broadly across a diverse set of companies and industries to limit the risk of and the impact that a potential downturn could have on our overall portfolio. We target a diverse investment portfolio with an average investment size of 1-2% per portfolio company. Churchill’s investment teams seek to identify new transactions based on the following key criteria, while also applying in-depth fundamental underwriting and credit research to produce reliable investment decisions designed to minimize potential losses:

Established Companies with Attractive Business Prospects

We seek to invest in core U.S. middle market companies typically generating between $10 million to $100 million of annual EBITDA, which we believe have developed strong and sustainable leading positions within their respective markets. These companies must also exhibit the potential to maintain sufficient cash flows and profitability to service their obligations across various economic environments, while continuing to grow and/or maintain their market position. To this end, we screen for non-cyclical companies with market-leading products and/or services, attractive industry fundamentals, strong pricing power and ability to pass through inflationary cost pressures, low capital expenditures requirements, as well as diversification of customers, products and suppliers. Furthermore, we seek to invest in companies with defensible market niches and barriers to entry and analyzes the strength of potential target companies by comparing them against similar businesses and competitors. We typically avoid reimbursement dependent, cyclical or commodity-driven industries.

Proven Management Teams with Established Track Records

When selecting investments, we focus on companies that possess experienced, high-quality management teams with a demonstrated track record of success. Examples of qualities sought in the portfolio company management teams include, but are not limited to, prior success operating in a leveraged environment and a demonstrated ability to adapt to challenging economic or business conditions. We also review the management team’s tenure and compensation structure to ensure their interests are aligned with the long-term success of the portfolio company, which provides us additional comfort in the portfolio company investment.

Strong Financial Performance

We perform comprehensive quantitative analysis on the historical and projected financial performance of a potential investment in a target company. Ideal target companies have strong and scalable revenues, and stable, predictable cash flows with low technology and market risk. Additionally, we seek companies that can demonstrate more than sufficient ability to service and repay debt obligations, have strong asset values and are resilient through different economic cycles. During the underwriting process, we develop multiple cash flow models reflecting different economic and operating scenarios, including a downside case that incorporates interest rate sensitivities to evaluate the company’s ability to service its debt in a rising rate environment, among other factors. These factors are

used to identify and underwrite investments that present a strong potential return relative to the overall risk profile, while guiding to the appropriate capital structure through various economic conditions.

High-Quality Private Equity Sponsors

We focus on participating in transactions sponsored by what it believes to be high-quality private equity firms, as primarily determined by a private equity firm’s record of historical investment performance. Target investment opportunities typically include transactions where a private equity sponsor is willing to contribute significant equity capital as a percentage of enterprise value. We believe that private equity sponsors with significant equity capital at risk generally have the ability and strong incentive to support a borrower through a challenging economic environment with a variety of managerial, operational and financial resources, including potentially providing additional capital to the borrowers. We also evaluate a private equity sponsor’s role in the target company’s corporate governance and management which means the private equity sponsor is more likely to have an active and influential role in the Company’s operations and day-to-day activities. These factors, if identified, provide additional comfort and protection for our investments.

Share Repurchase Plan

On October 27, 2023, our Board approved the Company 10b5-1 Plan, pursuant to which the Company may purchase up to $100 million in the aggregate of our outstanding shares of common stock in the open market at prices below our NAV per share over a specified period. Any purchase of our shares pursuant to the Company 10b5-1 Plan will be conducted in accordance with the guidelines and conditions of Rule 10b-18 and Rule 10b5-1 of the Exchange Act. We intend to put the Company 10b5-1 Plan in place because we believe that, in the current market conditions, if our shares of common stock are trading below our then-current NAV per share, it will be in the best interest of our shareholders for us to reinvest in our portfolio.

The Company 10b5-1 Plan is designed to allow us to repurchase our shares of common stock at times when we otherwise might be prevented from doing so under insider trading laws. The Company 10b5-1 Plan requires BofA Securities, Inc., as our agent, to repurchase shares of common stock on our behalf when the market price per share is below the most recently reported NAV per share (including any updates, corrections or adjustments publicly announced by us to any previously announced NAV per share). Under the Company 10b5-1 Plan, the agent will increase the volume of purchases made as the price of our shares of common stock declines, subject to volume restrictions. The timing and amount of any share repurchases will depend on the terms and conditions of the Company 10b5-1 Plan, the market price of our shares of common stock and trading volumes, and no assurance can be given that any particular amount of shares of our common stock will be repurchased.

The purchase of our shares of common stock pursuant to the Company 10b5-1 Plan is intended to satisfy the conditions of Rule 10b5-1 and Rule 10b-18 under the Exchange Act, and will otherwise be subject to applicable law, including Regulation M, which may prohibit purchases under certain circumstances. See “The Company—Share Repurchase Plan.”

The Company 10b5-1 Plan will become effective 60 calendar days following the end of the “restricted period” under Regulation M and terminate upon the earliest to occur of (i) 12-months (tolled for periods during which the Company 10b5-1 Plan is suspended), (ii) the end of the trading day on which the aggregate purchase price for all shares of common stock purchased under the Company 10b5-1 Plan equals $100 million and (iii) the occurrence of certain other events described in the Company 10b5-1 Plan.

The “restricted period” under Regulation M will end upon the closing of this offering and, therefore, the shares of common stock repurchases/purchases described above will not begin prior to 60 days after the closing of this offering. Under Regulation M, the restricted period could end at a later date if the underwriters were to exercise their over-allotment to purchase shares of our common stock in excess of their short position at the time that they complete their initial distribution of shares of our common stock. In such event, the restricted period would not end until the excess shares of our common stock were distributed by the underwriters or placed in their investment accounts. However, the underwriters have agreed to only exercise their over-allotment option to cover their actual short positions, if any. Therefore, the restricted period under Regulation M will end on the closing of this offering.

Use of Leverage

The amount of leverage we use in any period depends on a variety of factors, including cash available for investing, the cost of financing and general economic and market conditions. We may borrow money from time to time if immediately after such borrowing, the ratio of our total assets (less total liabilities other than indebtedness represented by senior securities) to our total indebtedness represented by senior securities plus preferred stock, if any, is at least 150%. This means that we generally can borrow up to $2 for every $1 of investor equity. See “Regulation — Senior Securities; Coverage Ratio” for more information regarding the foregoing and other regulatory considerations.

In any period, our interest expense will depend largely on the extent of our borrowing and we expect interest expense will increase as we increase our leverage over time subject to the limits of the 1940 Act. In addition, we may dedicate assets to financing facilities.

We currently have in place two special purpose vehicle asset credit facilities (the “Wells Fargo Financing Facility” and the “SMBC Financing Facility”), a revolving credit facility (the “Revolving Credit Facility” and together with the Wells Fargo Financing Facility and the SMBC Financing Facility, the “Financing Facilities”), and two term debt securitizations (the “2022 Debt Securitization” and “2023 Debt Securitization”). We also had in place a revolving credit facility with a borrowing base calculated based on our unfunded capital commitments (the “Subscription Facility”). The Subscription Facility expired on September 8, 2023. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” for more information. In the future, subject to the leverage limitations under the 1940 Act, we may enter into additional indebtedness, including credit facilities, term debt securitizations, and the issuance of unsecured notes. As of September 30, 2023, our asset coverage was 173.74%. Based on our estimated NAV as described in “Recent Developments,” we expect our asset coverage ratio to be between approximately 203.46% and 203.75% based on the value of our assets as of December 31, 2023, as adjusted to reflect the receipt of proceeds from the capital call drawdown notice we delivered on December 21, 2023, the dividend reinvestment payable on or about January 10, 2024, and the amount of indebtedness outstanding under the Financing Facilities and the CLOs. We expect our asset coverage ratio to be between approximately 225.06% and 225.41% based on our estimated NAV as of December 31, 2023 as described in the section entitled “Recent Developments,” as further adjusted for the receipt of proceeds from this offering and the subsequent repayment of indebtedness as disclosed in the section entitled “Use of Proceeds.”

See “Risk Factors — Risks Related to the Company’s Business — We are exposed to risks associated with changes in interest rates”; “Risk Factors — Risks Related to the Company’s Business and Structure — Regulations governing our operation as a BDC affect our ability to and the way in which we raise additional capital.”; “The Company — General”; and “Regulation” for more information.

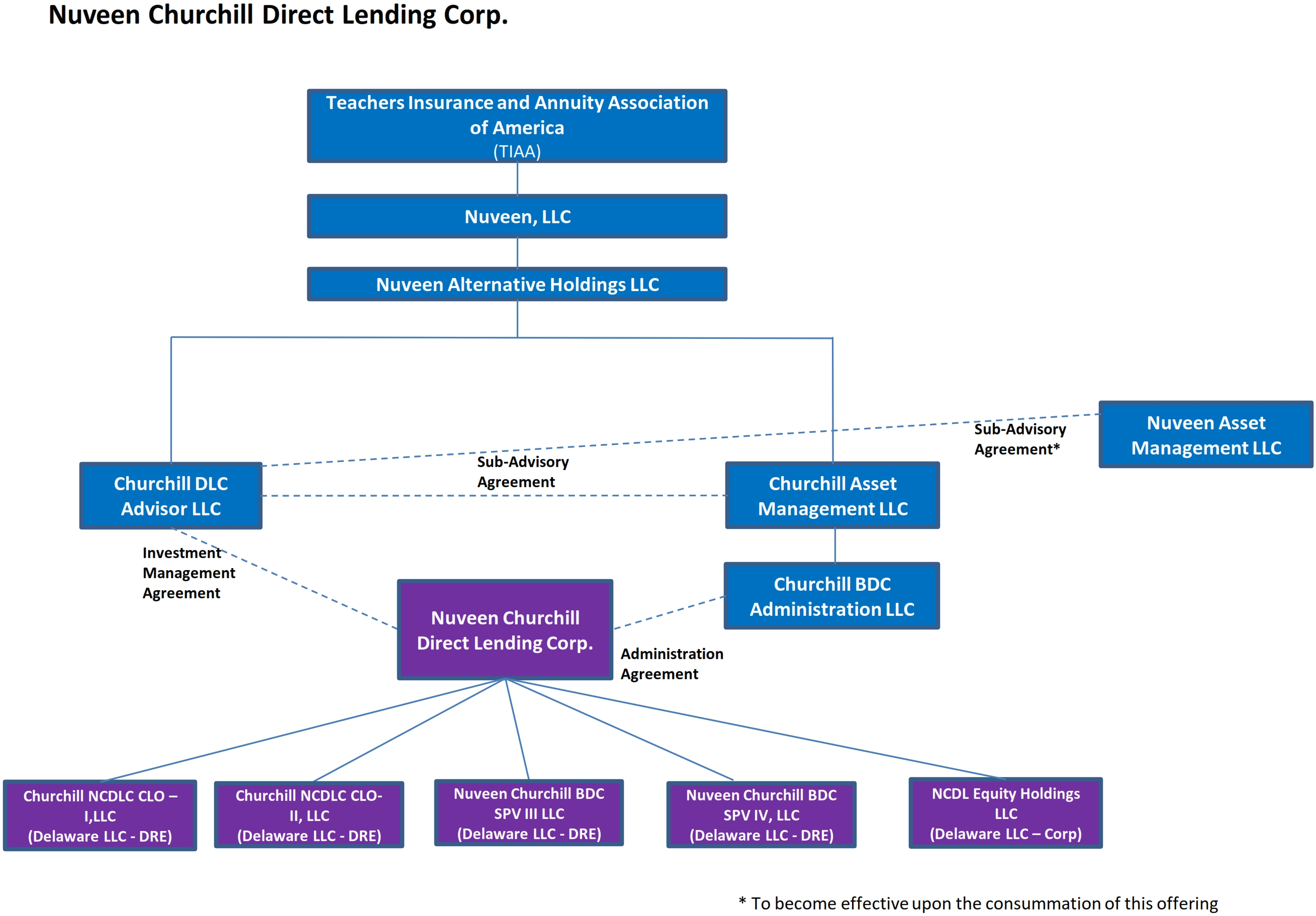

Organization and Corporate Structure

The following chart depicts our ownership structure:

Effective June 1, 2020, we changed our name from “Nuveen Churchill BDC, Inc.” to “Nuveen Churchill Direct Lending Corp.”

Beginning with our initial closing in March 2020, we have conducted private offerings of our shares of common stock to accredited investors. As of January 15, 2024, as a result of these private offerings, we had received an aggregate of approximately $906.4 million from such private offerings, of which $100 million was from TIAA. Following the final drawdown notice dated December 21, 2023, we had no undrawn capital commitments remaining.

The Adviser — Churchill DLC Advisor LLC

Churchill DLC Advisor LLC, a Delaware limited liability company, serves as our investment adviser pursuant to the Advisory Agreement. The Adviser is responsible for the overall management of our activities pursuant to the Advisory Agreement.

The Adviser has delegated substantially all of its daily portfolio-management obligations as set forth in the Advisory Agreement to Churchill pursuant to the CAM Sub-Advisory Agreement, which was approved by our board of directors (the “Board”), including a majority of our directors who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of us, the Advisers, or of any of their respective affiliates (the “independent directors”). The Adviser has general oversight over the investment process on our behalf and manages our capital structure, including, but not limited to, asset and liability management. The Adviser also has ultimate responsibility for our performance under the terms of the Advisory Agreement.

The Sub-Adviser — Churchill Asset Management LLC

Churchill serves as our Sub-Adviser pursuant to the CAM Sub-Advisory Agreement. Churchill provides investment advisory and management services to us. Under the terms of the CAM Sub-Advisory Agreement, Churchill: (i) identifies, evaluates and negotiates the structure of investments (including performing due diligence on prospective portfolio companies); (ii) closes and monitors investments; and (iii) determines the securities and other assets to be purchased, retained or sold. The Adviser and Churchill have entered into the CAM Sub-Advisory Agreement, which has been approved by our Board, and the terms of which provide Churchill with broad delegated authority to oversee our portfolio.

In addition to serving as our Sub-Adviser, Churchill manages other middle market investment strategies for affiliated entities such as TIAA, its ultimate parent company, as well as for third-party institutional investors, private funds, CLOs and separate accounts, Nuveen Churchill Private Capital Income Fund, a BDC, and NC SLF Inc., a closed-end investment company registered under the 1940 Act.

Churchill managed (directly or as a sub-adviser) approximately $50 billion of committed capital across its integrated capital solutions platform as of January 1, 2024. Churchill managed a range of vehicles, including BDCs, a registered closed-end investment company, separate accounts, structured finance products, and private funds investing in private middle market leveraged loans, subordinated debt, equity related securities, private equity, limited partner commitments, and related strategies. Of its approximately $50 billion of committed capital across the platform, Churchill manages approximately $13 billion in limited partner capital commitments to approximately 300 private equity funds on behalf of TIAA’s general account and third-party investors as one of the largest and most active private equity fund investment programs focused on the core U.S. middle market. Churchill offers a full array of solutions across the capital structure, benefiting from the investment guidance of its principals who have a long history of disciplined investing in the middle market across various economic cycles. With over $30 billion of committed capital dedicated to middle market private credit as of January 1, 2024, Churchill provides us with the ability to invest in larger transactions while limiting concentration in our portfolio. While it is managed and operated independently of TIAA and Nuveen, Churchill benefits from the scale, capital and resources of its parent companies, which we believe gives it the unique perspective of an asset owner while it executes its investment management strategies in the middle market through its network of leading private equity relationships.

The Investment Committee