UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| | |

| NUVEEN CHURCHILL DIRECT LENDING CORP. |

(Name of Registrant as Specified In Its Charter)

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Nuveen Churchill Direct Lending Corp.

430 Park Avenue, 14th Floor

New York, New York 10022

April 4, 2023

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Nuveen Churchill Direct Lending Corp. (the “Company”) to be held on May 18, 2023 at 2:00 p.m., Eastern Time (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format setting only. You can participate in the Annual Meeting, vote and submit questions via live audio webcast by visiting www.virtualshareholdermeeting.com/Churchill2023 and entering your control number on your proxy card or voting instruction form.

Your vote is very important! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting shareholder votes.

The Notice of the Annual Meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the meeting. The Annual Meeting is being held for the following purposes:

(i) to elect two members of the board of directors of the Company (the “Board”) to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified; and

(ii) to transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Board unanimously recommends that you vote FOR the proposal to be considered and voted on at the Annual Meeting.

The Company has elected to provide access to its proxy materials to its shareholders over the Internet under the Securities and Exchange Commission’s (the “SEC”) “notice and access” rules. On or about April 7, 2023, the Company intends to mail to its shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy statement and annual report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) and how to submit proxies over the Internet or by telephone. The Notice of Internet Availability of Proxy Materials also contains instructions on how you may request from us, free of charge, hard copies of the proxy statement, the proxy card and the Annual Report. The Company believes that providing its proxy materials over the Internet will expedite shareholders’ receipt of proxy materials, lower the costs associated with the Annual Meeting and conserve resources.

It is important that your shares of the Company’s common stock, par value $0.01 per share, be represented at the Annual Meeting. If you are unable to attend the Annual Meeting, I encourage you to vote your proxy on the Internet or by telephone by following the instructions provided on the Notice of Internet Availability of Proxy Materials. Your vote and participation in the governance of the Company are very important.

Sincerely yours,

Kenneth Kencel

President and Chief Executive Officer

NUVEEN CHURCHILL DIRECT LENDING CORP.

430 Park Avenue, 14th Floor

New York, New York 10022

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On May 18, 2023

To the Shareholders of Nuveen Churchill Direct Lending Corp.:

NOTICE IS HEREBY GIVEN THAT the annual meeting of shareholders of Nuveen Churchill Direct Lending Corp., a Maryland corporation (the “Company”), will be held on May 18, 2023 at 2:00 p.m. Eastern Time (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format setting only, and will be conducted via live audio webcast. It is important to note that shareholders have the same rights and opportunities by participating in the virtual meeting as they would if attending an in-person meeting. You will be able to participate in the Annual Meeting, vote and submit your questions via live audio webcast by visiting www.virtualshareholdermeeting.com/Churchill2023. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying proxy statement under the heading “How do I attend and vote at the Annual Meeting.”

The Annual Meeting is being held for the following purposes:

1.To elect two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified; and

2.To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Board has fixed the close of business on March 20, 2023 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof.

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on May 18, 2023. The Company’s proxy statement, the proxy card, and the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) are available at www.virtualshareholdermeeting.com/Churchill2023 and www.proxyvote.com. This proxy statement and the Annual Report also can be found on our website at www.churchillam.com/nuveen-churchill-direct-lending-corp under the “SEC Filings” tab or the SEC’s EDGAR website at www.sec.gov.

Your vote is important regardless of the number of shares that you own. If you are unable to participate in the Annual Meeting, we encourage you to vote your proxy on the Internet or by telephone by following the instructions provided on the Notice of Internet Availability of Proxy Materials. You may also request from us, free of charge, hard copies of the proxy statement and proxy card for the Company by following the instructions on the Notice of Internet Availability of Proxy Materials.

By Order of the Board of Directors,

John McCally

Vice President and Secretary

April 4, 2023

This is an important meeting. To ensure proper representation at the Annual Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materials to vote your proxy via the Internet or by telephone, or request, complete, sign, date and return a proxy card. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or subsequently executed proxy, or by attending the Annual Meeting and voting virtually. Instructions on how to vote while participating at the Annual Meeting live via the Internet are posted at www.virtualshareholdermeeting.com/Churchill2023.

NUVEEN CHURCHILL DIRECT LENDING CORP.

430 Park Avenue, 14th Floor

New York, New York 10022

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On May 18, 2023

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the date of the Annual Meeting and where will it be held?

The annual meeting (the “Annual Meeting”) of shareholders of Nuveen Churchill Direct Lending Corp., which is sometimes referred to in this proxy statement as “we,” “us,” “our,” or the “Company,” will be held in a virtual meeting format setting only on May 18, 2023. You will be able to participate in the Annual Meeting, vote and submit your questions via live audio webcast by visiting www.virtualshareholdermeeting.com/Churchill2023.

What will I be voting on at the Annual Meeting?

At the Annual Meeting, holders of the Company’s common stock (each, a “Shareholder”) will be asked to elect each of Kenneth Kencel and Stephen Potter to the Board of Directors (the “Board”) for a three-year term, expiring at the 2026 annual meeting of shareholders and until their respective successor is duly elected and qualified.

Who can vote at the Annual Meeting?

Only Shareholders of record as of the close of business on March 20, 2023 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments thereof.

How many votes do I have?

Shareholders are entitled to one vote for each share held as of the Record Date.

How do I attend and vote at the Annual Meeting?

The Company will be hosting the Annual Meeting live via audio webcast. Any Shareholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/Churchill2023. If you were a Shareholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

Attending the Annual Meeting Virtually. The Company will be hosting the Annual Meeting live via audio webcast. Any Shareholder can participate in the Annual Meeting live online at www.virtualshareholdermeeting.com/Churchill2023. If you were a Shareholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

•Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/Churchill2023.

•Assistance with questions regarding how to attend and participate via the Internet will be provided at TFN: 844-986-0822 / International 303-562-9302, 30 minutes before the start of the virtual Annual Meeting.

•Webcast starts at 2:00 p.m., Eastern Time.

•You will need your control number located on your Notice of Internet Availability of Proxy Materials to enter the Annual Meeting.

•Shareholders may submit questions while attending the Annual Meeting via the Internet.

To attend and participate in the Annual Meeting, you will need the control number located on your Notice of Internet Availability of Proxy Materials. If you lose your control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote, ask questions or access the list of Shareholders as of the Record Date. The Company will have technicians ready to assist with any technical difficulties Shareholders may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

Voting by Proxy through the Internet. You may authorize a proxy through the Internet using the web address included in your Notice of Internet Availability of Proxy Materials. Authorizing a proxy through the internet requires you to input the control number located on your Notice of Internet Availability of Proxy Materials. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the Internet link.

Voting by Proxy by Telephone. You may authorize a proxy by telephone by using the telephone number included in your Notice of Internet Availability of Proxy Materials and following the instructions provided in your Notice of Internet Availability of Proxy Materials. Authorizing a proxy by telephone requires you to input the control number located on your Notice of Internet Availability of Proxy Materials. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the telephone call.

Voting by Proxy through the Mail. You may also request from us, free of charge, hard copies of the proxy statement and proxy card for the Company by following the instructions on the Notice of Internet Availability of Proxy Materials. When voting by proxy and mailing your proxy card, you are required to:

•indicate your instructions on the proxy card;

•date and sign the proxy card;

•mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and

•allow sufficient time for the proxy card to be received on or before 11:59 p.m., Eastern Time, on May 17, 2023.

Does the Board recommend voting for Proposal 1?

Yes. The Board unanimously recommends that you vote “FOR” the proposal.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

The accompanying proxy is solicited on behalf of the Board for use at the Annual Meeting to be held on May 18, 2023 at 2:00 p.m., Eastern Time. The Annual Meeting will be held in a virtual meeting format setting only, and will be conducted via live audio webcast. Only holders of record of our common stock as of the Record Date will be entitled to vote at the Annual Meeting. As of the Record Date, we had 28,743,877 shares of common stock, par value $0.01 per share (the “Shares”), outstanding and entitled to vote. This proxy statement (the “Proxy Statement”) is being provided to the Shareholders via the Internet on or about April 7, 2023. In addition, a Notice of Internet Availability of Proxy Materials containing instructions on how to access the Proxy Statement and annual report on Form 10-K for the fiscal year ended December 31, 2022 (the “Annual Report”) and how to submit proxies over the Internet or by telephone are being sent to our Shareholders of record on or about April 7, 2023. The Annual Report and this Proxy Statement both can be accessed online at www.virtualshareholdermeeting.com/Churchill2023 and www.proxyvote.com.

All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if a proxy is properly executed and received by the Company (and not revoked) prior to the Annual Meeting, the Shares represented by the proxy will be voted FOR the election of two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified. Should any matter not described above be properly presented at the Annual Meeting, the named proxies will vote in accordance with their best judgment as permitted.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the Record Date.

The Annual Meeting is being held for the following purposes:

1.To elect two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified; and

2.To transact such other business as may properly come before the Annual Meeting, or any postponement or adjournment thereof.

Record Date

The Board has fixed the close of business on March 20, 2023 as the Record Date for the determination of Shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof. As of the Record Date, there were 28,743,877 Shares outstanding.

Quorum Required

A majority of the outstanding Shares entitled to vote at the Annual Meeting must be present or represented by proxy at the Annual Meeting in order to have a quorum. If you have properly voted by proxy via Internet, telephone or mail, you will be considered part of the quorum. Abstentions and “broker non-votes” will be treated as shares present for determining whether a quorum is established.

Vote Required

| | | | | | | | | | | | | | | | | | | | |

| Proposal | | Vote Required | | Broker Discretionary Voting Allowed | | Effect of Abstentions and Broker Non-Votes |

| Proposal 1 – To elect two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified. | | Affirmative vote of a plurality of the votes cast at the Annual Meeting virtually or by proxy. | | No | | Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, do not affect the outcome. |

You may vote “for,” “withhold authority” or abstain from voting on Proposal 1. The adoption of Proposal 1 requires the affirmative vote of the plurality of votes cast for such proposal at the Annual Meeting virtually or by proxy, meaning votes cast for such nominee’s election must exceed the votes withheld from such nominee’s election. Votes to “withhold authority” with respect to a nominee will not be voted with respect to the person indicated. Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, will have no effect on this Proposal 1.

Voting

You may vote at the Annual Meeting by using the virtual control number contained in the Notice of Internet Availability of Proxy Materials or by proxy in accordance with the instructions provided below. You also may authorize a proxy through the Internet or by telephone using the web address or telephone number, as applicable, included in your Notice of Internet Availability of Proxy Materials. These options require you to input the control number located on your Notice of Internet Availability of Proxy Materials. After inputting the control number, you will be prompted to direct your proxy to vote on the proposal. You will have an opportunity to review your voting instructions and make any necessary changes before submitting your voting instructions and terminating the telephone call or Internet link. Shareholders who vote via the Internet, in addition to confirming your voting instructions prior to submission, will also receive an e-mail confirming your instructions upon request. When voting by proxy and mailing your proxy card, you are required to:

•indicate your instructions on the proxy card;

•date and sign the proxy card;

•mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and

•allow sufficient time for the proxy card to be received on or before 11:59 p.m., Eastern Time, on May 17, 2023.

If your Shares are held in street name, these proxy materials are being forwarded to you by your account holder, along with voting instructions. As the beneficial owner, you have the right to direct your account holder how to vote your Shares, and the account holder is required to vote your Shares in accordance with your instructions. Your broker cannot vote your Shares on your behalf without your instructions. A “broker non-vote” with respect to a matter occurs when a broker, bank or other nominee holding Shares on behalf of a beneficial owner votes on some matters on the proxy card, but not on other matters, because the broker has not received voting instructions from the beneficial owner on a particular proposal and does not have discretionary authority (or declines to exercise discretionary authority) to vote the Shares on such proposal. Brokers, banks and other nominees will not have discretionary authority to vote on the proposals with respect to the election of directors (Proposal 1). In addition, as the beneficial owner of our Shares, you are entitled to participate in the Annual Meeting. If you are a beneficial owner, however, you may not vote your Shares at the Annual Meeting unless you obtain a legal proxy executed in your favor from the account holder of your Shares.

You may receive more than one proxy statement and proxy card or voting instructions form if your Shares are held through more than one account (e.g., through different account holders). Each proxy card or voting instructions form only covers those Shares held in the applicable account. If you hold Shares in more than one account, you must provide voting instructions as to all your accounts to vote all your Shares.

Important notice regarding the availability of proxy materials for the Annual Meeting. The Company’s Proxy Statement, the proxy card, and the Company’s Annual Report are available at www.virtualshareholdermeeting.com/Churchill2023 and www.proxyvote.com. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and Annual Report.

If you plan to attend the Annual Meeting and vote your Shares virtually, you will need your control number located on your Notice of Internet Availability of Proxy Materials in order to be admitted to the Annual Meeting.

Quorum and Adjournment

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, virtually or by proxy, of the holders of a majority of the Shares outstanding on the Record Date will constitute a quorum.

If a quorum is not present at the Annual Meeting, the Chairman will have the authority to adjourn the Annual Meeting, from time-to-time without notice and without the vote or approval of the Shareholders, until a quorum is present.

Proxies for the Annual Meeting

The named proxies for the Annual Meeting are Kenneth Kencel and Shai Vichness (or their duly authorized designees), who will follow submitted proxy voting instructions. They will vote as the Board recommends herein as to any submitted proxies that do not direct how to vote on any item, and will vote on any other matters properly presented at the Annual Meeting in their judgment.

Expenses of Soliciting Proxies

The Company will pay the expenses of soliciting proxies to be voted at the Annual Meeting, including the cost of preparing and posting this Proxy Statement and the Annual Report to the Internet and the cost of mailing the Notice of Internet Availability of Proxy Materials and any requested proxy materials to the Shareholders. The Company has engaged Broadridge Financial Solutions, Inc., an independent proxy solicitation firm, to assist in the distribution of the proxy materials and tabulation of proxies. The cost of Broadridge’s services with respect to the solicitation of proxies for the Annual Meeting is estimated to be approximately $15,986, plus reasonable out-of-pocket expenses.

Revocability of Proxies

A Shareholder may revoke any proxy that is not irrevocable by attending the Annual Meeting and voting virtually or by delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company. Shareholders have no appraisal or dissenters’ rights in connection with the proposal described herein.

Contact Information for Proxy Solicitation

You can contact us by mail sent to the attention of the Vice President and Secretary of the Company, John McCally, at our principal executive offices located at 430 Park Avenue, 14th Floor, New York, New York 10022. You can call us by dialing (212) 478-9200. You can access our proxy materials online at www.virtualshareholdermeeting.com/Churchill2023 and www.proxyvote.com.

Notice of Internet Availability of Proxy Materials

In accordance with regulations promulgated by the SEC, the Company has made this Proxy Statement, the Notice of Annual Meeting of Shareholders, and the Annual Report available to Shareholders on the Internet. Shareholders may (i) access and review the Company’s proxy materials, (ii) authorize their proxies, as described in “Voting” above and/or (iii) elect to receive future proxy materials by electronic delivery via the Internet address provided below.

This Proxy Statement, the Notice of Annual Meeting and the Annual Report are available at www.virtualshareholdermeeting.com/Churchill2023 and www.proxyvote.com.

Electronic Delivery of Proxy Materials

Pursuant to the rules adopted by the SEC, the Company furnishes proxy materials by email to those Shareholders who have elected to receive their proxy materials electronically. While the Company encourages Shareholders to take advantage of electronic delivery of proxy materials, which helps to reduce the environmental impact of annual meetings and the cost associated with the physical printing and mailing of materials, Shareholders who have elected to receive proxy materials electronically by email, as well as beneficial owners of Shares held by a broker or custodian, may request a printed set of proxy materials. The Notice of Internet Availability of Proxy Materials contains instructions on how you can elect to receive a printed copy of the Proxy Statement and the Annual Report.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information with respect to the beneficial ownership of our Shares, according to information furnished to us by such persons or publicly available filings, as of the Record Date by: (1) each director and director nominee of the Company; (2) the Company’s executive officers; (3) the executive officers and directors as a group; and (4) each person known to us to beneficially own 5% or more of our outstanding Shares. Ownership information for those persons who beneficially own 5% or more of the outstanding Shares is based upon filings by such persons with the SEC and other information obtained from such persons. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The percentage ownership is based on 28,743,877 Shares outstanding as of the Record Date. The number of Shares held by beneficial owners of 5% or more of our outstanding common stock is as of the date of the applicable SEC filing made by those owners (unless otherwise noted). To our knowledge, except as indicated in the footnotes to the table, each of the Shareholders listed below has sole voting and/or investment power with respect to our Shares beneficially owned by such Shareholder.

| | | | | | | | | | | | | | | | | |

| Name and Address | | | Number of Shares Owned | | Percentage of Class Outstanding |

| 5% Owners | | | | | |

Teachers Insurance and Annuity Association of America (1) | | | 3,671,631 | | 12.77% |

Kuvare Insurance Services LP (2) | | | 2,081,458 | | 7.24% |

Cresset Partners BDC Fund I, LLC (3) | | | 1,978,238 | | 6.88% |

| Interested Directors | | | | | |

Kenneth Kencel (4) | | | 19,440 | | * |

Michael Perry (5) | | | 13,609 | | * |

| Independent Directors | | | | | |

Reena Aggarwal (6) | | | 7,775 | | * |

| David Kirchheimer | | | 46,081 | | * |

Kenneth Miranda (7) | | | 5,832 | | * |

Stephen Potter (8) | | | 19,440 | | * |

| James Ritchie | | | 44,780 | | * |

| Executive Officers | | | | | |

Shai Vichness (9) | | | 3,888 | | * |

| Thomas Grenville | | | 389 | | * |

John McCally(10) | | | 2,380 | | * |

| Marissa Short | | | 389 | | * |

All officers and directors as a group (11 persons) (11) | | | 164,003 | | * |

* Less than 1%

(1) The address of Teachers Insurance and Annuity Association of America (“TIAA”) is 730 Third Avenue, New York, NY 10017. In connection with our formation, the Company issued and sold 50 Shares to TIAA for an aggregate purchase price of $1,000. Immediately prior to the Company’s election to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), Nuveen Churchill BDC SPV I LLC, a wholly owned subsidiary of the Company (“SPV I”), acquired all of the economic equity interests (the “Merger”) of Churchill Middle Market CLO V Ltd. (the “Predecessor Entity”), a Cayman exempt limited company managed as a collateralized loan obligation vehicle that was managed by Nuveen Alternatives Advisors LLC and sub-advised by Churchill Asset Management LLC (“Churchill”). In connection with the consummation of the Merger, and prior to our election to be regulated as a BDC under the 1940 Act, the Company issued 3,310,540 Shares to TIAA in exchange for all of the outstanding preference shares of the Predecessor Entity, which was then merged into SPV I, as a result of which the Predecessor Entity became our wholly owned consolidated subsidiary (through its successor-in-interest, SPV I). On May 20, 2022, SPV I changed its name to Churchill NCDLC CLO-I, LLC.

(2) The address of Kuvare Insurance Services LP is 55 W. Monroe St., Suite 1930, Chicago, IL 60641.

(3) The address of Cresset Partners BDC Fund I, LLC is 444 W. Lake St. Ste. 4700, Chicago, IL 60606.

(4) Mr. Kencel holds all of his Shares indirectly through a joint account, pursuant to which he has shared voting and dispositive power. All of Mr. Kencel’s Shares are pledged as security in a margin loan account. Nuveen Churchill Advisors LLC, the Company’s investment adviser (the “Adviser”), consented to such pledge in accordance with the Company’s subscription agreement.

(5) Mr. Perry holds all of his Shares indirectly through an individual retirement account.

(6) Dr. Aggarwal holds all of her Shares indirectly through Aggarwal LLC, of which she is CEO and retains sole voting and dispositive power with respect to such Shares.

(7) All of Mr. Miranda’s Shares are pledged as security in a margin loan account. The Adviser consented to such pledge in accordance with the Company’s subscription agreement.

(8) Mr. Potter holds all of his Shares directly through a trust.

(9) All of Mr. Vichness’s Shares are pledged as security in a margin loan account. The Adviser consented to such pledge in accordance with the Company’s subscription agreement.

(10) Mr. McCally holds all of his Shares indirectly through a joint account, pursuant to which he has shared voting and dispositive power.

(11) The address for each of the directors and officers of the Company is c/o Nuveen Churchill Direct Lending Corp., 430 Park Avenue, 14th Floor, New York, NY 10022.

PROPOSAL 1: ELECTION OF DIRECTOR NOMINEES

At the Annual Meeting, Shareholders are being asked to consider the election of two directors of the Company. Pursuant to the Company’s bylaws, the number of directors on the Board may not be less than one or more than nine. Under the Company’s Articles of Amendment and Restatement (the “Charter”), the directors are divided into three classes. Each class of directors holds office for a three-year term. However, the initial members of the three classes had initial terms of one, two, and three years, respectively. The Board currently consists of seven directors who serve in the following classes: Class I (terms ending at the 2024 annual meeting of shareholders) — Michael Perry, David Kirchheimer and Kenneth Miranda; Class II (terms ending at the 2025 annual meeting of shareholders) — Reena Aggarwal and James Ritchie; and Class III (terms ending at the Annual Meeting) — Kenneth Kencel and Stephen Potter.

Each of Kenneth Kencel and Stephen Potter has been nominated for election by the Board to serve a three-year term until the 2026 annual meeting of shareholders and until their respective successor is duly elected and qualified. Each director nominee has agreed to serve as a director if re-elected at the Annual Meeting and has consented to being named as a nominee in this Proxy Statement.

A Shareholder can vote “for,” “withhold authority” or abstain from voting his, her or its vote from the nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each of the director nominees named below in accordance with the recommendation of the Board. If any of the director nominees should decline or be unable to serve as a director, the persons named as proxies will vote for such other nominee as may be proposed by the Nominating and Corporate Governance Committee (the “Nominating Committee”). The Board has no reason to believe that any of the persons named as director nominees will be unable or unwilling to serve.

Required Vote

Each director nominee will be elected to the Board if the votes cast for such nominee's election exceed the votes withheld from such nominee’s election. If a Shareholder votes to “withhold authority” with respect to a nominee, the shares will not be voted with respect to the person indicated. Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, will have no effect on this Proposal 1. There will be no cumulative voting with respect to Proposal 1.

Information about the Director Nominees and Directors

Set forth below is information regarding Messrs. Kencel and Potter, who are being nominated for election as directors of the Company by the Shareholders at the Annual Meeting, as well as information about the Company’s other current directors whose terms of office will continue after the Annual Meeting. Neither Mr. Kencel nor Mr. Potter is being proposed for election pursuant to any agreement or understanding between either Mr. Kencel or Mr. Potter, on the one hand, and the Company or any other person or entity, on the other hand.

The information below includes specific information about each director’s experience, qualifications, attributes or skills that led the Board to the conclusion that the individual is qualified to serve on the Board, in light of the Company’s business and structure. There were no legal proceedings of the type described in Item 401(f)(7) and (8) of Regulation S-K in the past 10 years against any of our directors, director nominees or officers, and none are currently pending.

Nominees for Class III Directors — Terms Expiring 2023:

Mr. Kencel is an “interested person” of the Company as defined in the 1940 Act due to his position as the Chief Executive Officer and President of the Company and Chief Executive Officer and President of Churchill. The Board has determined that Mr. Potter is not an “interested person” (as defined in the 1940 Act) of the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

| Interested Director | | | | | | | | | |

| Kenneth Kencel, 64 | | Director | | Chief Executive Officer and President of Churchill, the Company, NC SLF Inc. and Nuveen Churchill Private Capital Income Fund | Class III Director since 2019, Term expires in 2023 | | 3 | | Canisius High School NC SLF Inc. Nuveen Churchill Private Capital Income Fund |

Kenneth Kencel, Chief Executive Officer, President & Chairman

Kenneth Kencel has served as Chief Executive Officer, President and Chairman of the Board of the Company since December 2019 and has served as President and Chief Executive Officer of Churchill since 2015. Mr. Kencel has served as the Chief Executive Officer, President and Chairman of the Board of NC SLF Inc., a closed-end fund registered under the 1940 Act, since March 2021, and Nuveen Churchill Private Capital Income Fund, a BDC, since March 2022. Throughout his over 35-year career in the investment industry, Mr. Kencel has accrued a broad range of experience in leading private credit investment businesses. Previously, Mr. Kencel served as a Managing Director of The Carlyle Group, and from May 2014 to April 2015, he also served as President and a Director of TCG BDC, Inc. (Carlyle’s publicly traded business development company). Previously, he founded and was President and CEO of Churchill Financial Group; and served as Head of Leveraged Finance for Royal Bank of Canada as well as Head of Indosuez Capital—a leading middle market merchant banking and asset management business in partnership with Credit Agricole Group. Mr. Kencel also helped to found the high yield finance business at Chase Securities (now JP Morgan Chase). He began his career in the Mergers & Acquisitions Group at Drexel Burnham Lambert.

Mr. Kencel serves on the Pension Investment Advisory Committee for the Archdiocese of New York, the Board of Trustees and Chairman of the Investment Committee of Canisius High School and the Advisory Board of Teach for America (Connecticut). Mr. Kencel is a guest lecturer at Boston University Questrom School of Business and a former member of the Board of Advisors and Adjunct Professor at the McDonough School of Business at Georgetown University. He earned his B.S. in Business Administration, magna cum laude, from Georgetown University and his J.D. from Northwestern University Pritzker School of Law.

We believe Mr. Kencel’s numerous management positions, as well as his depth of experience with corporate finance and middle market investments, give the Board valuable industry-specific knowledge and expertise on these and other matters, and his history with Churchill provides an important skillset and knowledge base to the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

| Independent Director | | | | | | | | | |

| Stephen Potter, 66 | | Director | | President of Northern Trust Asset Management | Class III Director since 2019, Term expires in 2023 | | 2 | | Miami Corporation

Rush University Medical Center

Duke University Trinity College

British American Business Council Solti Foundation American School in London US Foundation

Japan America Society of Chicago

Rush System for Health

Walter Scott & Partners Nuveen Churchill Private Capital Income Fund |

Stephen Potter

Stephen Potter has served as a director of the Company since December 2019 and a director of Nuveen Churchill Private Capital Income Fund since March 2022. From 2008-2017, prior to his retirement, Mr. Potter served as President of Northern Trust Asset Management (NTAM), a large global asset management firm, and as CEO of Northern Trust Investments, a registered investment adviser. From 2001-2008, Mr. Potter served as CEO of Northern Trust Global Services, Ltd. and led all of Northern Trust’s business activities outside the United States. In his various leadership roles at Northern Trust Corporation, Mr. Potter actively engaged with the board of directors and regulators focused on business strategy, risk management and long term talent development. Mr. Potter currently serves on the boards of Miami Corporation, Rush University Medical Center, Duke University Trinity College, the British American Business Council, the Solti Foundation, the American School in London US Foundation, Japan America Society of Chicago, Rush System for Health, Walter Scott & Partners in Edinburgh and the Social & Economic Advisory Board of the RAND Corporation in Santa Monica, CA. Mr. Potter is currently Chairman of the Japan America Society of Chicago. Mr. Potter holds an A.B. in Economics and History from Duke University and an M.B.A. in Finance and Marketing from Northwestern University.

We believe Mr. Potter’s management positions and experiences with business strategy and risk management provide the Board with valuable skills and insight.

Incumbent Class I Directors — Terms Expiring 2024:

Mr. Perry is an “interested person” of the Company as defined in the 1940 Act due to his position as Executive Vice President and Head of U.S. Advisory Services for Nuveen, LLC (“Nuveen”), the parent company of the Adviser. The Board has determined that each of Messrs. Kirchheimer and Miranda is not an “interested person” of the Company as defined in the 1940 Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

| Interested Director | | | | | | | | | |

| Michael Perry, 56 | | Director | | Executive Vice President and Head of U.S. Advisory Services for Nuveen | Class I Director since 2019, Term expires in 2024 | | 2 | | Youth, Inc.

Nuveen Churchill Private Capital Income Fund |

Michael Perry

Michael A. Perry has served as a director of the Company since December 2019. Mr. Perry is an Executive Vice President and the Head of the Global Client Group for Nuveen, which is responsible for deploying Nuveen’s insights, capabilities and solutions to best serve Wealth and Institutional clients. Mr. Perry also has served as a trustee of Nuveen Churchill Private Capital Income Fund, also managed by the Adviser, since March 2023. He is a member of Nuveen’s Executive Leadership Team, providing expertise across Nuveen’s asset management business with a focus on growing revenue through new business opportunities and expanded relationships with current clients. Previously, he led Nuveen’s U.S. and Global distribution teams, and was head of Global Product where he helped build and grow the firm’s closed-end fund and alternative investment businesses. Before joining Nuveen in 2015, he spent five years at UBS Wealth Management, where he was a member of the Executive Committee responsible for investment advisory programs and manager research, planning, funds, alternative investments, insurance and the UBS Trust Company. Prior to that, he spent 15 years at Merrill Lynch as a senior executive leading a number of capital market and investment advisory businesses focused on the wealth management channel. Mr. Perry graduated with a B.S. in Industrial and Operations Engineering from the University of Michigan and an

M.B.A. from the New York University Stern School of Business. He is a board member for Youth, Inc., a non-profit that empowers organizations serving New York City youth.

Mr. Perry is a valuable member of the Board because of his extensive experience with alternative investments and retail, high net worth and institutional client channels. We believe Mr. Perry’s depth of experience in corporate finance, capital markets and financial services gives the Board valuable industry-specific knowledge and expertise on these and other matters, and his history with Nuveen provides an important skillset and knowledge base to the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

| Independent Directors | | | | | | | | | |

| David Kirchheimer, 67 | | Director | | Director | Class I Director since 2019, Term expires in 2024 | | 2 | | CURO Group Holdings Corp.

NC SLF Inc. |

| Kenneth Miranda, 62 | | Director | | Chief Investment Officer of Cornell University | Class I Director since 2019, Term expires in 2024 | | 1 | | |

David Kirchheimer

David M. Kirchheimer has served as a director of the Company since December 2019 and a director of NC SLF Inc. since May 2021. Mr. Kirchheimer has served as an Advisory Partner at Oaktree Capital Management (an honorary position) (“Oaktree”) since his retirement from Oaktree in March 2017. Prior thereto, he was the Chief Financial Officer of Oaktree and a director of its then-publicly owned affiliate. Before joining Oaktree at its founding in 1995 as Chief Administrative and Financial Officer, Mr. Kirchheimer’s 16 years of experience consisted primarily of serving as Executive VP and CFO of Republic Pictures Corporation, a then-publicly held entertainment company, and PricewaterhouseCoopers, where he became a Certified Public Accountant (now inactive) and rose to senior audit manager. Mr. Kirchheimer currently serves on the board of CURO Group Holdings Corp. where he is the Lead Independent Director and Chair of its Audit Committee. He also is a director of Huntington Hospital in Pasadena, CA, a trustee of its trust and a director of Cedars-Sinai Health System, its parent entity. Additionally, with his restaurateur son, Mr. Kirchheimer owns and manages a small collection of restaurants in Utah. Mr. Kirchheimer served on the financial advisory panel of The Aerospace Corporation from June 2018 until June 2021, when the panel was dissolved. He graduated Phi Beta Kappa and summa cum laude with a B.A. degree in economics from Colorado College and earned an M.B.A. in accounting and finance from the Booth School of Business of the University of Chicago.

We believe Mr. Kirchheimer’s numerous management positions and broad experiences in the financial services sector provide him with skills and valuable insight in handling complex financial transactions and issues, all of which make him well qualified to serve on the Board.

Kenneth Miranda

Kenneth M. Miranda has served as a director of the Company since December 2019. He was appointed Cornell University’s Chief Investment Officer effective July 1, 2016. Prior to this, he had been the Director of the International Monetary Fund’s Investment Office and has served as a visiting scholar at the International Monetary Fund. He also served as an advisor to the Administration Committee of the IMF Staff Retirement Plan. He currently serves as a member of the Advisory Committee on Investments for the Food and Agriculture Organization, and up until June 30, 2016, was a member of the Investment Committee of Cornell University. In addition, he served on the

Investment Sub-Committee of the National Geographic Society. Formerly, he was the President of the Board of Directors of the Bank-Fund Staff Federal Credit Union and a Senior Advisor on the George Washington University Committee on Investments. He holds a Ph.D. in Economics from the University of Chicago, a B.S. in Foreign Service from Georgetown University, and is a CFA charter holder.

We believe Mr. Miranda’s investment experience, including serving as chief investment officer for a large endowment, provide an important skillset and knowledge base to the Board.

Incumbent Class II Directors — Term Expiring 2025

The Board has determined that each of Dr. Aggarwal and Mr. Ritchie is not an “interested person” of the Company as defined in the 1940 Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

| Independent Directors | | | | | | | | | |

| Reena Aggarwal, 65 | | Director | | Professor of Finance at Georgetown University; Director, Georgetown’s Psaros Center for Financial Markets and Policy; and Vice Provost for Faculty at Georgetown University from 2016-2020 | Class II Director since 2019, Term expires in 2025 | | 1 | | Cohen and Steers

Dimensional Funds |

| James Ritchie, 68 | | Director | | Director | Class II Director since 2019, Term expires in 2025 | | 3 | | Kinsale Capital Group, Inc.

NC SLF Inc.

Nuveen Churchill Private Capital Income Fund |

Reena Aggarwal

Reena Aggarwal has served as a director of the Company since December 2019. Dr. Aggarwal is currently the Robert E. McDonough Professor of Finance at Georgetown University and the Director of Georgetown’s Psaros Center for Financial Markets and Policy. She has been on the faculty of Georgetown University since 1986. Her focus is in the areas of corporate governance, ESG, capital raising, IPOs, institutional investors, ETFs, private equity, valuation, global financial markets and securities market regulation. Dr. Aggarwal has previously held various positions including Vice Provost for Faculty, Interim Dean and Deputy Dean of Georgetown's McDonough School of Business; Visiting Professor of Finance at MIT's Sloan School of Management; FINRA Academic Fellow; Academic Fellow at the U.S. SEC; Visiting Research Scholar at the International Monetary Fund; Fulbright Scholar

to Brazil; and World Economic Forum Global Agenda Council on the Future of Financing and Capital; and a Distinguished Scholar at the Reserve Bank of India’s CAFRAL. Dr. Aggarwal serves on the Board of Cohen and Steers and Dimensional Funds. Dr. Aggarwal previously served on the Board of New York Life Investment Management IndexIQ (2008-2021), Brightwood Capital Advisors, LLC (2013-2020), and REAN Cloud (2015-2018). She received a Ph.D. in finance from the University of Maryland and M.M.S. from BITS Pilani, India.

We believe Dr. Aggarwal’s depth of knowledge of financial issues and corporate governance experience provide her with skills and valuable insight in serving on the board of an investment company, which make her well-qualified to serve on the Board.

James J. Ritchie

James J. Ritchie has served as a director of the Company since December 2019, a director of NC SLF Inc. since March 2021 and a director of Nuveen Churchill Private Capital Income Fund since March 2022. He also currently serves on the board of Kinsale Capital Group, Inc., a Richmond-based specialty insurance company. At various times from 2007 to 2018, he served as chairman of the boards of Brightsphere Investment Group plc, a global asset management firm, F&G Life Insurance Company, a life & annuity insurance company and Quanta Capital Holdings, Ltd., a property and casualty insurance holding company. Prior to serving as chairman of the boards of these firms, he chaired their respective audit committees as well as those of KMG America Corporation, a life and health insurance company, Ceres Group, Inc., a health insurance company, Lloyds Syndicate 4000 and Old Mutual Bermuda, a Bermuda-based financial services company. From 2001 to 2003, he served as CFO of White Mountains Insurance Group, Ltd., a Bermuda-based insurance holding company. Prior thereto, he held senior management positions in Cigna Corporation and Price Waterhouse (now PricewaterhouseCoopers). He is a member of the National Association of Corporate Directors and the American Institute of Certified Public Accountants. Mr. Ritchie received an MBA from the Rutgers Graduate School of Business Administration and an AB economics degree with honors from Rutgers College.

We believe Mr. Ritchie’s broad experiences in the financial services and accounting sectors provide him with skills and valuable insight in handling complex financial transactions and accounting issues, all of which make him well qualified to serve on the Board.

________________________

(1)The address for each director is c/o Nuveen Churchill Direct Lending Corp., 430 Park Avenue, 14th Floor, New York, NY 10022.

(2)The term “Fund Complex” refers to (a) the Company, (b) NC SLF Inc., a closed-end fund registered under the 1940 Act whose investment adviser is affiliated with the Adviser, and is the sub-adviser to the Company and (c) Nuveen Churchill Private Capital Income Fund, a BDC whose investment adviser is affiliated with the Adviser, and is the sub-adviser to the Company.

Dollar Range of Equity Securities Beneficially Owned by Directors

The table below shows the dollar range of equity securities of the Company and the aggregate dollar range of equity securities of the Company that were beneficially owned by each director as of the Record Date stated as one of the following dollar ranges: None; $1 – $10,000; $10,001 – $50,000; $50,001 – $100,000; or Over $100,000.

| | | | | | | | |

| Name | | Dollar Range of Equity Securities Beneficially Owned (1)(2) |

| Interested Directors | | |

| Kenneth Kencel | | Over $100,000 |

| Michael Perry | | Over $100,000 |

| Independent Directors | | |

| Reena Aggarwal | | Over $100,000 |

| David Kirchheimer | | Over $100,000 |

| Kenneth Miranda | | Over $100,000 |

| Stephen Potter | | Over $100,000 |

| James Ritchie | | Over $100,000 |

________________________

(1) Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

(2) Dollar ranges were determined using the number of Shares that are beneficially owned as of the Record Date, multiplied by the Company’s net asset value per share as of December 31, 2022, which was $18.32.

Information about Executive Officers Who Are Not Directors

The following sets forth certain information regarding the executive officers of the Company who are not directors of the Company.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Officer Since |

| Shai Vichness | | 40 | | Chief Financial Officer and Treasurer | | 2019 |

| Thomas Grenville | | 51 | | Chief Compliance Officer | | 2019 |

| John McCally | | 43 | | Vice President and Secretary | | 2019 |

| Marissa Short | | 39 | | Controller | | 2019 |

The address for each of the Company’s executive officers is c/o Nuveen Churchill Direct Lending Corp., 430 Park Avenue, 14th Floor, New York, NY 10022.

Shai Vichness, Chief Financial Officer and Treasurer

Shai Vichness serves as Chief Financial Officer and Treasurer of the Company, NC SLF Inc. and Nuveen Churchill Private Capital Income Fund and as a Senior Managing Director and Chief Financial Officer of Churchill. Previously, as Managing Director and Head of Senior Leveraged Lending for Nuveen, Mr. Vichness was responsible for initiating Nuveen’s investment program in middle market senior loans and was directly involved in the launch of Churchill as an affiliate in 2015. Since the launch of Churchill, Mr. Vichness has been a member of Churchill’s Investment Committee and has been actively engaged in the management of the firm, including the development of its infrastructure and operations. Mr. Vichness joined Nuveen in 2005 and has spent his entire career in the private debt markets, with a significant amount of time spent in the firm’s workout and restructuring department. Mr. Vichness holds a B.B.A. from Baruch College, CUNY and is a CFA charterholder.

Thomas Grenville, Chief Compliance Officer

Thomas Grenville is the Chief Compliance Officer of the Company, NC SLF Inc. and Nuveen Churchill Private Capital Income Fund and has served as chief compliance officer for various Nuveen affiliates since 2010. Prior to joining, Mr. Grenville was at the U.S. Securities and Exchange Commission for seven years, where he led examinations of hedge funds, investment companies and investment advisers. He also worked for two years at the State of Oregon’s Division of Finance and Corporate Securities. Mr. Grenville received a B.A. from Swarthmore College, a J.D. from Benjamin N. Cardozo Law School, an L.L.M. in Environmental and Natural Resources Law from Lewis and Clark Law School and a M.B.A. from the University of California, Berkeley. He is a member of the Oregon Bar, and has been designated as a Certified Fraud Examiner by the Association of Certified Fraud Examiners (ACFE).

John McCally, Vice President and Secretary

John McCally is a Vice President and the Secretary of the Company, NC SLF Inc. and Nuveen Churchill Private Capital Income Fund and serves as the General Counsel for Churchill after establishing Churchill with the Churchill Financial Founders in 2015. Mr. McCally has served in the TIAA and Nuveen legal departments since 2010, including as the head of legal for Nuveen Leveraged Finance. Mr. McCally also provides legal support for various investment and asset management teams within the Nuveen and TIAA businesses, including those engaged in public and private fixed income, derivatives and structured products. Prior to joining the organization in 2010, Mr. McCally was an associate with Cadwalader, Wickersham & Taft LLP, specializing in derivatives, structured products and investment management, based in its Washington, DC office. Mr. McCally received a B.A. from Duke University and a juris doctor from The George Washington University Law School.

Marissa Short, Controller

Marissa Short joined Churchill in 2018 and currently serves as Controller of the Company, NC SLF Inc. and Nuveen Churchill Private Capital Income Fund, and as Managing Director, Funds Controller of Churchill. Previously, she was a senior manager in the Wealth and Asset Management Practice at Ernst & Young LLP, responsible for the planning, implementation, and completion of financial statement audits for top tier SEC and non-SEC clients. Ms. Short received her B.S. in Accounting and Business Administration from Lehigh University and is a Certified Public Accountant in the State of New York.

CORPORATE GOVERNANCE

The Board

Board Composition

The Board consists of seven members. The Board is divided into three classes, with the members of each class serving staggered, three-year terms; however, the initial members of the three classes had initial terms of one, two and three years, respectively. The terms of the Company’s Class III directors will expire at the Annual Meeting; the terms of the Company’s Class I directors will expire at the 2024 annual meeting of shareholders; and the terms of the Company’s Class II directors will expire at the 2025 annual meeting of shareholders.

Messrs. Kencel and Potter serve as Class III directors (with terms expiring at the Annual Meeting). Messrs. Perry, Kirchheimer and Miranda serve as Class I directors (with terms expiring in 2024). Dr. Aggarwal and Mr. Ritchie serve as Class II directors (with terms expiring in 2025).

Independent Directors

Pursuant to the Charter, a majority of the Board will consist of directors who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company, the Adviser, and Churchill, its sub-adviser (together with the Adviser, the “Advisers”), or of any of their respective affiliates (the “Independent Directors”). On an annual basis, each member of the Board is required to complete a questionnaire eliciting information to assist the Board in determining whether the Independent Directors continue to be independent under the Exchange Act and the 1940 Act. The Board limits membership on the Audit Committee, the Nominating Committee and the Special Transactions Committee to Independent Directors.

Based on these independence standards and the recommendation of the Nominating Committee, after reviewing all relevant transactions and relationships between each director, or any of his or her family members, and the Company, the Advisers, or of any of their respective affiliates, the Board has determined that Dr. Aggarwal and Messrs. Kirchheimer, Miranda, Potter and Ritchie qualify as Independent Directors. Each director who serves on the Audit Committee is an independent director for purposes of Rule 10A-3 under the Exchange Act.

Interested Directors

Messrs. Kencel and Perry are considered “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company because they are officers of the Adviser.

Meetings and Attendance

The Board met six times during the fiscal year ended December 31, 2022 and took action on various occasions by unanimous written consent. Each of the incumbent directors attended at least 75% of the aggregate of the Board meetings and meetings of the committee(s) on which he or she served during the last fiscal year and while he or she served as a director.

Board Attendance at the Annual Meeting

The Company’s practice is to encourage its directors to attend each annual meeting of shareholders; however, such attendance is not required at this time. A majority of the directors attended the 2022 annual meeting of shareholders.

Board Leadership Structure

The Board monitors and performs an oversight role with respect to the business and affairs of the Company, compliance with regulatory requirements and the services, expenses and performance of its service providers. Among other things, the Board approves the appointment of, and reviews and monitors the services and activities performed by, our Advisers, our administrator, Nuveen Churchill Administration LLC (the “Administrator”) and our officers, and approves the engagement, and reviews the performance of, the Company’s independent registered public accounting firm.

Under the bylaws, the Board may designate a chair to preside over the meetings of the Board and meetings of the Shareholders and to perform such other duties as may be assigned to the chairman by the Board. The Company does not have a fixed policy as to whether the chairman of the Board should be an Independent Director and believes that the flexibility to select its chairman and reorganize its leadership structure, from time to time, based on the criteria that is in the best interests of the Company and the Shareholders.

Kenneth Kencel currently serves as the chairman of our Board. Mr. Kencel is an ‘‘interested person’’ of the Company as defined in Section 2(a)(19) of the 1940 Act because he is an officer of the Company and Churchill. We believe that Mr. Kencel’s history with Churchill, familiarity with our investment objective and investment strategies, and extensive knowledge of the financial services industry and the investment valuation process in particular qualify him to serve as the chairman of our Board. We believe that, at present, we are best served through this leadership structure, as Mr. Kencel’s relationship with Churchill provides an effective bridge and encourages an open dialogue beween our management and our Board, ensuring that all groups act with a common purpose. We are aware of the potential conflicts that may arise when a non-Independent Director is chairman of the Board, but believe these potential conflicts are offset by our strong corporate governance policies. Our corporate governance policies include regular meetings of the Independent Directors in executive session without the presence of the interested directors; the establishment of the Audit Committee, the Nominating Committee and the Special Transactions Committee, which are comprised solely of Independent Directors; and the appointment of a Chief Compliance Officer, with whom the Independent Directors meet regularly without the presence of the interested directors and other members of management, and who is responsible for administering our compliance policies and procedures. The Board also believes that its leadership structure is appropriate in light of the Company’s characteristics and circumstances because the structure allocates areas of responsibility among the individual directors and the committees in a manner that encourages effective oversight. The Board also believes that its size creates a highly efficient governance structure that provides ample opportunity for direct communication and interaction between the Adviser and the Board. We recognize that different board leadership structures are appropriate for companies in different situations. We intend to continue to re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet our needs.

The Board currently does not have a designated lead Independent Director. However, Mr. Ritchie, the chairman of the Audit Committee, is an Independent Director and acts as a liaison between the Independent Directors and management between meetings of the Board and is involved in the preparation of agendas for Board and committee meetings.

The Board’s Role in Risk Oversight and Compliance

The Board performs its risk oversight function primarily through (a) the Audit Committee, the Nominating Committee and the Special Transactions Committee (collectively, the “Committees”), which report to the entire Board and are comprised solely of Independent Directors, and (b) reports received from the Company’s Chief Compliance Officer in accordance with the Company’s compliance policies and procedures.

As described below in more detail under the “Audit Committee,” “Nominating and Corporate Governance Committee” and “Special Transactions Committee” subsections below, the Committees assist the Board in fulfilling its risk oversight responsibilities. The Audit Committee’s risk oversight responsibilities include overseeing the Company’s accounting and financial reporting processes, the Company’s systems of internal controls regarding finance and accounting and audits of the Company’s financial statements and discussing with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such

exposures, including the Company’s risk assessment and risk management policies. The Nominating Committee’s risk oversight responsibilities include nominating directors for election by the Shareholders in the event of director vacancies, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and the Committees. The Special Transactions Committee’s risk oversight responsibilities include reviewing and making certain findings in respect of co-investment transactions and monitoring compliance with the conditions of the Order (as defined below), as well as certain other matters pertaining to potential or actual conflicts of interest.

The Board also performs its risk oversight responsibilities with the assistance of the Company’s Chief Compliance Officer. The Chief Compliance Officer prepares a written report quarterly discussing the adequacy and effectiveness of the compliance policies and procedures of the Company and certain of its service providers. The Chief Compliance Officer’s report, which the Board reviews quarterly, addresses at a minimum: (a) the operation of the Company’s compliance policies and procedures and certain of its service providers since the last report; (b) any material changes to such policies and procedures since the last report; (c) any recommendations for material changes to such policies and procedures as a result of the Chief Compliance Officer’s review; and (d) any compliance matter that has occurred since the date of the last report about which the Board would reasonably need to know to oversee the Company’s compliance activities and risks. In addition, the Chief Compliance Officer meets separately in executive session with the Independent Directors periodically, but in no event less than once each year.

The Company believes the role of the Board in risk oversight is effective and appropriate given the extensive regulation to which it is already subject as a BDC. Specifically, as a BDC, the Company must comply with certain regulatory requirements that control the levels of risk in its business and operations. For example, the Company’s ability to incur indebtedness is limited such that its asset coverage must equal at least 150% immediately after the Company incurs such indebtedness, and the Company generally has to invest at least 70% of its total assets in “qualifying assets.” In addition, the Company has elected, and intends to qualify annually, to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. As a RIC, the Company must, among other things, meet certain source-of-income and asset diversification requirements.

The Board believes its existing role in risk oversight is appropriate. However, the Board re-examines the manner in which it administers its oversight function on an ongoing basis to ensure that it continues to meet the Company’s needs.

Communications with Directors

Shareholders and other interested parties may contact any member (or all members) of the Board by mail. To communicate with the Board, any individual directors or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent Nuveen Churchill Direct Lending Corp., 430 Park Avenue, 14th Floor, New York, NY 10022, Attention: Chief Compliance Officer.

Committees of the Board

The Board has an Audit Committee, a Nominating Committee and a Special Transactions Committee, and may form additional committees in the future. A brief description of each committee is included in this Proxy Statement, and the charters of the Audit and Nominating Committees can be accessed on the Company’s website at https://www.churchillam.com/nuveen-churchill-direct-lending-corp/.

Audit Committee

The Audit Committee held nine formal meetings during the fiscal year ended December 31, 2022 and took action by unanimous written consent.

The Audit Committee is composed of Reena Aggarwal, David Kirchheimer, Kenneth Miranda, Stephen Potter and James Ritchie, each of whom is an Independent Director. Mr. Ritchie serves as chair of the Audit

Committee. The Board has determined that each of Dr. Aggarwal, Mr. Kirchheimer and Mr. Ritchie is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K, as promulgated under the Exchange Act. Our Audit Committee members also meet the current independence and experience requirements of Rule 10A-3 of the Exchange Act.

The Audit Committee operates pursuant to a charter approved by our Board, which sets forth the responsibilities of the Audit Committee. The Audit Committee (a) assists the Board’s oversight of the integrity of our financial statements, the independent registered public accounting firm’s independence, qualifications and performance and our compliance with legal and regulatory requirements; (b) reviews and approves the Audit Committee report, as required by the SEC, to be included in our annual proxy statement; (c) oversees the scope of the annual audit of our financial statements, the quality and objectivity of our financial statements, accounting and policies and internal controls over financial reporting; (d) establishes guidelines and makes recommendations to the Board regarding the valuation of the Company’s investments, and is responsible for aiding the Board in determining the fair value of portfolio securities for which current market values are not readily available; (e) determines the selection, appointment, retention and termination of our independent registered public accounting firm, as well as approving the compensation thereof; (f) reviews reports regarding compliance with the Company’s Code of Business Conduct and Ethics; (g) pre-approves all audit and non-audit services provided to us by such independent registered public accounting firm; and (h) acts as a liaison between our independent registered public accounting firm and the Board.

Nominating and Corporate Governance Committee

The Nominating Committee held one formal meeting during the fiscal year ended December 31, 2022.

The Nominating Committee is comprised of Reena Aggarwal, David Kirchheimer, Kenneth Miranda, Stephen Potter and James Ritchie, each of whom is an Independent Director. Mr. Kirchheimer serves as chair of the Nominating Committee.

The Nominating Committee operates pursuant to a charter approved by our Board, which sets forth the responsibilities of the Nominating Committee. The Nominating Committee recommends to the Board persons to be nominated by the Board for election on an annual basis and in the event any vacancy on the Board may arise. The Nominating Committee will consider for nomination to the Board candidates submitted by our Shareholders or from other sources it deems appropriate. In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating Committee applies the criteria included in its charter. These criteria include the candidate’s standards of character and integrity, knowledge of the Company’s business and industry, conflicts of interest, willingness to devote time to the Company and ability to act in the interests of all Shareholders. The Nominating Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The Board does not have a specific diversity policy, but considers diversity of race, religion, national origin, gender, sexual orientation, disability, cultural background and professional experiences in evaluating candidates for board membership. The Board believes diversity is important because a variety of viewpoints contribute to an effective decision-making process.

The Nominating Committee also makes recommendations with regard to the tenure of the directors and is responsible for overseeing an annual evaluation of the Board and its committee structure to determine whether the structure is operating effectively.

Special Transactions Committee

The Special Transactions Committee took action by unanimous written consent by unanimous written consent.

The Special Transactions Committee is comprised of Reena Aggarwal, David Kirchheimer, Kenneth Miranda, Stephen Potter and James Ritchie, each of whom is an Independent Director. Mr. Potter serves as chair of the Special Transactions Committee.

The Special Transactions Committee is responsible for reviewing and making certain findings in respect of co-investment transactions under the conditions of the exemptive orders that the Company has been granted by the SEC on June 7, 2019 and October 14, 2022 (collectively, the “Order”) as well as certain other matters pertaining to actual or potential conflicts of interest.

Compensation Committee

The Company does not have a compensation committee because its executive officers do not receive compensation from us. The Board, as a whole, is responsible for reviewing the reimbursement by the Company to the Administrator of the allocable portion of the cost of the Company’s Chief Financial Officer and his staff and also participates in the consideration of the Independent Directors’ compensation.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that applies to the Company’s principal executive officer, principal financial officer, principal account officer or controller, any person performing similar functions and all employees of the Adviser and Nuveen that perform services on behalf of the Company. There have been no material changes to the Company’s Code of Business Conduct and Ethics or material waivers of the Code of Business Conduct and Ethics that apply to the Company’s Chief Executive Officer or Chief Financial Officer. If the Company makes any substantive amendment to, or grants a waiver from, a provision of its Code of Business Conduct and Ethics, the Company will promptly file a Form 8-K with the SEC. The Company will provide any person, without charge, upon request, a copy of the Code of Business Conduct and Ethics. To receive a copy, please provide a written request to: Nuveen Churchill Direct Lending Corp., 430 Park Avenue, 14th Floor, New York, NY 10022, Attention: Vice President and Secretary, John McCally.

Hedging Transactions

The Company’s Code of Ethics does not expressly prohibit directors, executive officers or employees of its affiliates from purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Shares. In fact, the Company’s Code of Ethics and Insider Trading Policy specifically permits hedging with puts or certain types of short sales unless the transaction is a covered call (which can be written when the director, executive officer, employee or affiliate acquires the underlying position), in which case such person must first hold the underlying position for 60 days.

Election of Executive Officers

Executive officers hold their office until their respective successor has been duly elected and qualified, or until the earlier of their respective resignation or removal.

Compensation Discussion and Analysis

We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided by individuals who are employees of the Advisers, the Administrator or their respective affiliates, pursuant to the terms of the Investment Advisory Agreement, the Sub-Advisory Agreement and the Administration Agreement (each as defined below), as applicable. Our day-to-day administrative operations are managed by the Administrator. Most of the services necessary for the origination and administration of our investment portfolio will be provided by investment professionals employed by Churchill or their respective affiliates.

Each of our executive officers is an employee of an affiliate of the Administrator. We reimburse the Administrator for our allocable portion of expenses incurred by the Administrator in performing its obligations under the Administration Agreement, including our allocable portion of the cost of our Chief Financial Officer and his staff, and we reimburse the Adviser for certain expenses under the Investment Advisory Agreement.

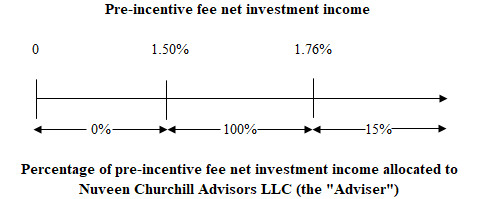

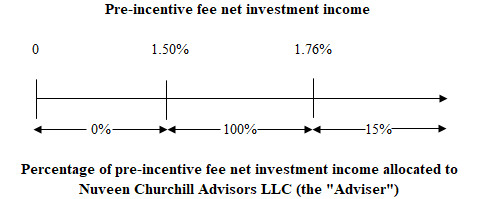

Director Compensation